Hayu signals content expansion as Australia’s average weekly streaming ‘grows by 500%’

Subscription video-on-demand platform Hayu has increased its Australian weekly streaming audience by 500% in the past year, the service has claimed, and will look to build out its offering through content expansion.

The service, which sources a large portion of its reality television programs from parent company NBCUniversal International, has been in the market for almost two years.

Since launch, Hayu has signed deals with Fetch and Telstra TV, allowing users to opt in for less than $6 a month. It also signed a deal with Foxtel, providing the service for free.

Hendrik McDermott, senior vice president of branded on demand and managing director of Hayu, told Mumbrella the differentiated offering, which is focused purely on reality TV shows, has helped establish the brand in the Australian market, and encouraged growth.

According to statistics provided by the platform, on average 12 hours of content was consumed per person per month, the equivalent of 20 to 30 episodes each.

Although it has previously been considered a rival of other SVOD services Stan, Netflix and Foxtel, McDermott remained adamant it was complementary to existing players.

“This isn’t intended to be a service that will cause the need to cancel any other services. It’s really an add on to existing services. The price point also allows it to be. For $5.99 you can have access to 5,000 episodes of content. That is a pretty exciting proposition that we think can easily sit alongside other services,” he said.

Richard Howard, vice president of marketing SVOD and branded on demand at NBCUniversal, added the demand for reality was “super strong” in Australia. That, coupled with a highly focused paid social, has helped establish the brand in the Australian market, he said.

Howard said the company is “super active” in the social space, particularly on Twitter, where the shows’ stars engage with their audiences. Twitter is also a good place for Hayu to interact with the television stars too, Howard added.

“It is a nice place where it shows off our brand’s personality. We like to have quite a lot of fun with that social content,” he said.

“We physically like to bring talent into the market as well because you know some really great cut through when we’ve managed to do that and then we also use the talent to engage audiences when we’ve had them in market. So it’s a really strong weapon.”

Despite the intense marketing efforts, he says launching in the Australia was difficult.

“I don’t think there’s any other challenges other than the big challenge that we had to create a new brand from scratch, communicate what our positioning was and get consumers to get what our service was offering. So I think nothing outside of that is a fairly hairy marketing challenge. But I actually think we’ve gained momentum in the Australian market and consumers are being extremely receptive to it,” he said.

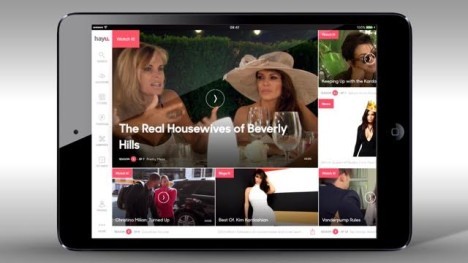

Hayu currently offers subscribers more than 6,000 episodes of reality TV content from NBC Universal – its parent company – and third parties. The content comes from the US’ big brands E!, Bravo and Oxygen, but more recently through Viacom International Media Networks (VIMN), with shows like The Hills and Laguna Beach added to the offering.

McDermott is not opposed to adding local programs to its lineup in the future.

“Yes certainly. The local content is something that we do and we do have local to the UK content. So for example we have shows like Made in Chelsea and Don’t Tell The Bride in the UK,” he said.

“It would be very carefully selected titles that resonate in the market. It’s not just local for the sake of local, but it would be in order to drive a specific audience.

“There is nothing that’s out of the question.”

McDermott said selecting new shows was really about the “best-quality content” and what subscribers wanted, pointing to Laguna Beach as an example of meeting the demands of those who subscribe.

On the thinking behind launching on Fetch and Telstra TV, McDermott said it was about meeting the needs of consumers, who wanted to watch the streaming service on television.

“Both Fetch and Telstra are fast-growing television platforms and of course what we’re trying to do is get our content to the widest group of people we can so for us, we are really trying to grow reach and distribution and there’s multiple ways to do that,” he said.

Looking to Australia’s audience growth, McDermott was surprised about the 2017 audience figures. He told Mumbrella it was “unexpected” and “not necessarily planned for”.

“It was initially difficult to convey brand message but now that we’ve managed to get that into the market, the people that we’ve found are just spending a lot of time on our platform,” he explained.

He is confident the subscription video market is still growing, and will be sustainable.

“Initial research shows that the SVOD model was growing quite rapidly. What we saw in our initial research was that the international marketplace was going to outstrip the growth in the US and Canada and that was one of the founding reasons for us to have created a service like this in order to participate in that growth.

“There is plenty of interest in subscription videos. There will be plenty of more growth to come.”

That deal for Foxtel customers has actually long since-lapsed. It was clever though because I found Hayu a much more robust streaming service, it’s Apple TV native and it’s cheap…so I just ditched Foxtel Now in favour Hayu (and just use Stan/Netflix for drama and docs). You do notice the lack of local content on Hayu though e.g. no Real Housewives of Melbourne despite Hayu having all the other iterations.

Would be fantastic if only he’d actually spend some money on his substandard streaming app. Constant bugs. Audi visual sync issues. Long duration outages (tonight for example (3.9.20). Very poorly designed layout. Never remembers where you got up to. Customer service just fobs you off, and replies to emails with stock standard responses, (likely due to how many complaints they are receiving). It really is a disaster of a platform. I’ve lost patience with it only 1 week in. Total crap!