Subscription Television: TV worth paying for

Australian subscription television (STV) has experienced considerable growth in terms of penetration and impact on the content production industry. Aravind Balasubramaniam spoke with pay TV executives about the future of their sector in the face of increased competition.

Australian subscription television (STV) has experienced considerable growth in terms of penetration and impact on the content production industry. Aravind Balasubramaniam spoke with pay TV executives about the future of their sector in the face of increased competition.

With an increased economic pressure on families and a wider range in free entertainment and information options available to most Australians, the subscription television sector faces an enormous challenge: anticipating future trends and offering new services that people perceive as being worth their hard earned money, and make them feel in control of their experience.

“The average subscriber is now looking for greater flexibility and control over their television viewing experience, which is why STV providers must prioritise services that include full functionality on demand, or downloadable content and web-enabled services,” said the CEO of ACT provider TransACT, Ivan Slavich.

Patrick Delaney, director of product development and sales at Foxtel, adds that company’s priority is to understand what customers want, and providing products and services that meet those needs.

“Technology and regulation should serve customers and come together at the price they want, while also allowing the provider a return on investment,” he said.

A recent report from the Commercial Economic Advisory Service of Australia found that STV advertising revenues reached $359m in the fiscal year 2009/10, and the sector showed a 13 percent growth during the same period, but even with such encouraging numbers, Australia still falls well behind the US (89%), the UK (58%) and even New Zealand (51%), with a 34 percent penetration.

At an average $42 for a basic subscription, potential subscribers need to be persuaded of the benefits of pay TV, an increasingly difficult task considering the growing number of FTA digital channels. It’s no secret that Foxtel CEO Kim Williams – who was unavailable for comment –openly criticised the ABC over the expansion of its content across wider delivery platforms, starting a battle of words with the public broadcaster’s executives. Tension and competition between FTA and STV seems to be on the rise.

According to Austar CEO John Porter, both the multi-channel free-to-air line-up and the emerging online industry have been influenced by the STV model and the services the sector has been offering for years.

“We introduced digital channels and interactive TV a full decade before the FTA sector joined the party, as well as electronic program guides, on-demand viewing, online products, high definition and 3D TV. A lot of the content that is now airing on FTA first appeared on subscription channels years ago, and more interestingly, the advertising structure appears to be changing.

“The FTA broadcasters rely entirely on advertising, and their main channels are losing viewers to the multi-channels at an amazing rate, yet they have somehow managed to convince advertisers that the value proposition remains the same. It will be interesting to see how long this persists,” he explained.

Porter believes the historical strength of the STV industry in the face of its competitors has been the delivery of channels with a well-defined target audience.

“Instead of one general news channel, we have eight; each is specifically designed for a certain target market. Despite the emergence of FTA multi-channels, STV will continue to offer the best multi-channel offering,” he argued. “We’ve seen very minimal change to our overall subscription viewing audience. The main growth of the FTA multi-channels has been from cannibalisation of their primary channels. What has been noticed is that niche genres on the platform have seen an uplift in viewing – lifestyle by 18 percent and documentaries by 10. Viewers know that if they want to watch something

specific, they can choose the time they watch instead of being dictated to them by the FTAs.”

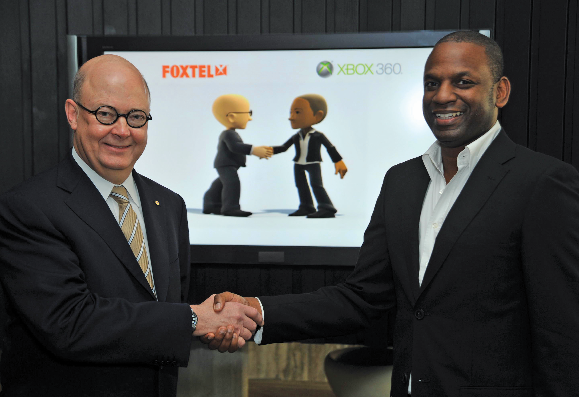

PARTNERSHIPS ARE NO GAME

With the proliferation of broadband access and gaming consoles in Australian homes, the STV sector has started expanding its services beyond the traditional set top box model, offering content download options and even new subscription products via gaming consoles. Last year, Foxtel partnered with Microsoft to offer Xbox Live, providing Xbox 360 owners the chance to access a selection of channels and video-on-demand services through the console – which offers a large base of users, with more than one million Xbox 360s sold in Australia. Last year alone, Australians spent more than 106 million hours on Xbox LIVE including gaming and social networking.

“The partnership with Xbox was monumental for us because it allowed viewers the option of not requiring a set-up-box,” explained Foxtel’s executive director of television, Brian Walsh. “It’s a product designed to reach segments of the market that we were having difficulty with, and my feeling is that it will be a consistent and steady growth product,” added Delaney.

The relationship between the STV provider and the IT giant was born from a mutual understanding of the potential of online TV.

“We didn’t choose Microsoft; it was more about both parties choosing each other,” said Delaney. “They are a great partner and the two services complement each other; they see a strong future in TV services being delivered via subscription.”

Both Foxtel and Austar have launched download and on-demand services, and are looking at the potential of tablets and ‘connected’ TV sets.

Delaney says Foxtel’s download to PC product has been very successful, “bearing in mind that we do catch up very well already, with the +2 hour channels and the fact that 70 percent of customers have our IQ PVRs.”

The video-on-demand service via Xbox 360 has also proven a hit with subscribers, and the feature has now been implemented on IQ boxes. In the case of Foxtel, the service is unmetered for Telstra BigPond customers – and a new partnership with the telco will see Telstra customers being able to receive Foxtel channels via their T-Box.

The previously prohibitive costs and download limitations of Australia’s internet connections are slowly becoming a thing of the past, allowing all of these new offerings to flourish.

“The huge demand for downloading in the entertainment marketplace will increasingly drive lower charges for downloads,” added Delaney.

The problem with STV [or pay TV] in Australia, is this. Its way over priced. For example, to get a Foxtel package which includes some movie channels, you’re looking at paying about $90 per month [or over $1000 per year]. Thats a lot of money to spend on watching TV, especially when you are also flooded with commercials.

Had pay-tv been cheaper, then people could justify spending the money. I for one would never consider paying $90 per month to watch TV. I’d rather spend that $90 on something else, and simply watch FTA digital channels or put it towards my credit card bill [or mortgage].

Australia also lacks any competition. Foxtel and Austar have agreed subscription regions, and neither can cross-sell within each other’s area. Or to put it bluntly – people have one choice – either Foxtel or Austar, depending on their location.

The entire industry needs to be overhauled and these monopolies need to be dismantled to allow decent competition in. Then and only then will prices drop and as a result see more people joining up.

FTA television needs to be more accessable in rural and remote areas. I believe a new satellite service is coming that will provide direct access to all the same digital channels that the city folk get. This is a service that will do wonders for rural Australia no longer receiving just four average channels. The sooner this service is available the better.

Some of us live in metropolitan areas yet we also have FTA accessibility problems and have no option but to get pay TV, even to watch the FTA channels. I live near Sydney Town Hall, and my building is surrounded by taller buildings. FTA reception is non-existent, and there’s nothing that the building management can/is willing to do. to improve it. We’re stuck with Foxtel and, since we only have the regular service, we can’t even get 7MATE and GEM – they’ve only included HD versions of those channels, available only through the more expensive Foxtel HD option.