The crown that slipped: What went wrong with Isentia’s $48m acquisition of King Content?

When King Content was sold to media monitoring company Isentia, the deal changed how the industry thought about the content marketing sector. But under its new ownership King Content soon stalled – and took Isentia’s dream of becoming a billion dollar company with it, as Steve Jones reports

It was grandly proclaimed as the deal that finally brought validation to the content marketing industry in Australia.

Far from being a buzzword for a vague and imprecise way of connecting brands with prospective customers, the transaction, it was suggested, proved that ad-free, brand-commissioned content was a legitimate and valuable approach to marketing.

Why else would listed media monitoring business Isentia have splashed out a headline-grabbing $48m for King Content, Australia’s largest and most recognised content marketing agency?

The industry that had spawned from the world of SEO had, so it seemed, arrived.

Isentia’s rationale for the deal appeared sound enough. Content marketing, the company said, would slot in nicely as the third pillar to its existing, but under pressure, media intelligence and insights business.

At the time of the announcement, Isentia was motoring. A few months after listing on the ASX, the company formerly known as Media Monitors had a market capitalisation that was approaching $700m and growing fast. A bullish CEO John Croll told Mumbrella: “I certainly think we can be a billion dollar company.”

At the same time, a Mumbrella journalist had asked King Content founder Craig Hodges whether he could deliver the numbers he had promised. He had answered bluntly, and in one word: “Yes.”

How Mumbrella reported Hodges in August 2015

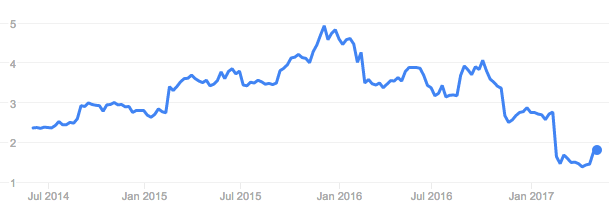

But today, Isentia is worth just a third of its 2015 peak, with its market capitalisation at $361m, taking its value below its 2014 listing price, after investors reacted to a trickle of bad news about King Content’s progress within Isentia.

Yet in the 12 months following the August 2015 acquisition – which took the industry by surprise at the time – the signs were positive.

Croll declared himself pleased with the performance of King Content in the first half of the 2016 financial year.

The full-year picture also looked solid. The agency, with Hodges still at the helm, “outperformed expectations” as client numbers tripled to 120 and pro forma revenue jumped 68%.

Croll’s bold acquisition seemed to be paying off, and Isentia’s share price nudged above $4.

And then King Content hit a wall.

In a trading update issued at Isentia’s AGM in mid-November – barely three months after the bullish FY16 results – Isentia’s share price plunged 26% after revealing King Content would lose $2m in the first half of the 2017 financial year.

Ups and downs of the Isentia share price

The business had “lost revenue momentum”, Croll said, with poor decision making around strategy, new business development and client retention all contributing to the decline. Furthermore, Hodges, for so long the darling of King Content and for content marketing generally, was shunted to an executive chairman role and a search launched for a new CEO.

Nevertheless, despite the dismal outlook, King Content was still expected to make a “positive contribution” come the end of the year.

Yet even that proved way beyond the business. Two weeks after the arrival of former Bauer Media boss Matt Stanton in February, King Content reported an 11% revenue decline with EBITDA losses for the full year expected to spiral to $3m. Shares in Isentia sunk further, hitting a low of $1.33 in April.

Australia’s content marketing King had lost its crown, and Isentia’s acquisition was under intense scrutiny.

A month later, Isentia announced the resignation of its chief financial officer Nimesh Shah – who, along with Croll, led Isentia’s acquisition strategy – “to pursue new challenges” after seven years with the company .

Pembroke: Acquisition was a good idea

In the days after the deal, David Pembroke, chief executive of content marketing agency contentgroup, wrote in Mumbrella how the deal was a shot in the arm for content marketing and would silence the “sneering and muttering” which sought to undermine the sector.

Subsequent events appear to have torpedoed such positivity. Yet Pembroke – perhaps unsurprisingly given he makes his living from the sector – remained convinced the deal made sense. Nor is King Content’s predicament a reflection on the sector, he said.

“Clearly there have been some major issues with the integration. With the benefit of hindsight, integrating a company with the velocity and culture of King Content into Isentia has been more difficult than they anticipated,” Pembroke told Mumbrella. “Things haven’t gone to plan, but I would still give it time. I’d still be backing them to make it a success.

“And just because this hasn’t been a success, as yet, doesn’t mean content marketing isn’t an effective approach. Quite the contrary, I’m more bullish than ever. As technology and the platforms continue to reshape the way we communicate, content marketing is only going to become more important to every brand, government and not for profit. It’s not going away.

“The deal drew unprecedented attention to the practice of content marketing which in my opinion validated the services and approach of content marketing agencies. I stand by my earlier views 100% and still think the combination of Isentia and King Content was and is a good idea.”

Isentia shareholders may beg to differ, notwithstanding this month’s improvement in the share price following a presentation which reported no further deterioration.

“No more bad news is clearly good news,” one analyst said.

In addition to lauding the deal, Pembroke had predicted Croll and Hodges would form a “formidable” partnership and exploit the opportunity ahead of them.

But rather than a harmonious working alliance, these “two old bulls”, as Pembroke described them, appeared to lock horns, particularly from the final quarter of 2016 when it became clear all was not well.

Within weeks of Stanton’s arrival, Hodges had gone – three months ahead of his planned exit – to the relief of both himself and Isentia.

Hodges declined to comment on his 18 months under Isentia’s ownership. But it is known he was glad to sever links with his new masters, with sources saying a clash of cultures had hindered the integration of King Content into Isentia.

“Craig Hodges is a good guy and a fantastic salesman, but he’s not a corporate guy. I don’t suppose he wanted to get that close to the Isentia business and that would have created friction particularly when cracks started appearing,” one industry source said. “When Matt Stanton arrived it was inevitable Craig would leave early. It was Isentia’s business and they needed their man to run the show. I think it’s also fair to say Craig may have lost that drive and hunger under new ownership.”

Yet according to another observer, cracks were evident before Isentia arrived on the scene. Regardless of Isentia’s struggle to integrate King Content as effectively as they had hoped, the agency was struggling to deliver a consistently high quality of work amid a culture driven by sales, particularly as it continued to expand at pace.

“I don’t know of any agency that weighted itself in a sales structure quite as heavily as King Content,” one source said. “It was sell, sell, sell without the rigour and structure and process to deliver against that. That’s not to say they didn’t produce good work but generally, as it grew, it was maybe selling beyond its capability which is why clients drifted away.”

Hodges: A fantastic salesman

Hodges had also overseen global expansion into the US, UK and Asia. In time-honoured fashion for relatively small but ambitious firms, King Content was said to have expanded too quickly, spreading its resources too thin across too many markets and too many industry sectors.

It led to what one senior content creator described as a cookie cutter approach as King Content stretched itself, if not to breaking point then to a place where corners needed to be cut.

“When, as a relatively small business, you set up in Melbourne, Perth, London, Asia and the US, controlling the quality is difficult and we are not talking about selling words and articles here. We are talking about trying to offer a sophisticated, integrated, creative, digital and strategically-focused offering,” they said.

King Content was also among the most competitively-priced content agencies, observers said. While often attractive to clients with little or no experience of content marketing who were thus unwilling to invest too heavily, such an approach risked compromising quality. Mumbrella was told writers and other content creators were poorly paid compared to rivals – one writer reported historical rates of 15 cents per word – in order to keep costs down and improve margins.

“King Content skated that line between quality and price,” one source said.

“Strategically the plan was to grow and expand while content marketing was hot and get to a position where they could flip it.

“They were not building it with a long-term vision, they were building it to sell.

“But over time, that growth and the rising expectation of clients was always going to be hard to manage. They did some top work but when you expand quickly, maintaining that level gets harder. They went off the boil.”

Hodges’ widely-recognised quality as a salesman was instrumental in that growth, and a strength that undoubtedly helped secure the hefty $48m price tag. Ultimately, because earnout targets will not be hit, Isentia is only expected to pay $34m for King Content, a figure which still takes some justifying based on current performance.

“Sure, King Content rapidly grew revenue but was it sustainable revenue?,” questioned one agency employee.

Freelance journalist and content marketing consultant Jonathan Crossfield rejected suggestions made by some that King Content was often a case of style over substance.

He argued its issues may be indicative of wider challenges in the industry rather than any fundamental problem unique to King Content.

Crossfield: Hodges is a force of nature

“Craig is a force of nature, a great salesman and he knows how to run a business and shake hands with the right people,” Crossfield told Mumbrella.

“He certainly knows how to get a pitch across the line. But also, I think he absolutely believed in what they were doing.

“I don’t think he was trying to pull the wool over anyone’s eyes or to put a lot of glitter on this, sell it and then run which I am sure some might be thinking. It’s far more complex and, I think, symptomatic of the industry trying to find that balance between content quality and quantity – both clients and agencies.”

Crossfield added that the greatest challenge is in the sheer volume of content being produced by agencies and clients, coupled with marketers’ impatience to see quick results in what is often a long-term brand-building exercise.

“Content marketing as a strategy is a long-term game. It’s not something where clients will necessarily see a great return within six months,” he said. “It’s a common dilemma: how to find that balance to be able to do good work, repeatedly, and allow it to scale and still satisfy clients who don’t want to wait too long to see if it’s working. I have seen industry client churn within six months and that is often not long enough to work out what is going on.”

Fergus Stoddart, managing partner at Edge who worked with Hodges in the years prior to King Content’s founding, described the content space as a “difficult area” and suggested agencies are grappling with a need to invest while working with small margins.

“The ability to create good, smart content at scale and speed and do it well and work in the data piece for personalisation is challenging,” he told Mumbrella. “It’s really easy to do an average job but to do it well you need to build in the strategic and creative capability on top of the digital marketing smarts, tech and data know-how that a really good digital agency would have.

Stoddart: Some brands are expecting miracles

“Once you start looking at it properly and trying to be the genuine article, it’s difficult. You have to invest a lot of skills and resources to do so and the margins are tight so you can see how companies can get themselves in trouble. This could have been the case with King.”

Stoddart added that people are expecting to “create miracles” with little investment, with some marketers still looking for a quick sales fix. Such thinking is holding back the sector, he said.

“There is short-term thinking and that leads to insufficient investment in strategy and in turn poor output. It’s slowing down the growth of content marketing and affects its reputation. People are expecting to create miracles with little or no financial resource put into it.

“Yes, you can have short-term content campaigns. Social media is driving a lot of content marketing and that is inherently timely and provides a short-term opportunity. But key is getting the underlying strategy right and taking a long-term perspective that ensures you are continually connecting the dots of all the different content interactions. That allows you to develop a stronger and deeper relationship with customers.”

Short termism was also identified by Pembroke as an on-going issue. He said the stock market needs to be educated that the “world is changing” and that firms should no longer be punished for less-than-bumper interim financial results.

“Marketers often want a quick fix and that is part of the problem,” Pembroke said. “They are still trapped in that short-term thinking whereas the audience has moved on and wants brands to take more time, get to know them, and build engagement over time. That’s the big shift that we are seeing.

“The old methods of marketing are no longer relevant to modern behaviours and people need to shift their thinking. Stock markets should do likewise, or companies needs to explain to the stock markets that ‘Hey, the world is changing’.”

Quaintance: Too many second rate freelancers

Storyation head of content Lauren Quaintance told Mumbrella the sector was still in its infancy, saying there is a lingering perception that content marketing has a low cost of entry.

“But, like anything, you get what you pay for,” she said. “For all the talk about quality, too often marketers and agencies leave the ideation and creation of content to second-rate freelancers and lowly-paid interns. That’s a sign of the immaturity of the content marketing industry in Australia. We need to have real debate about what quality means.”

Questionmarks over the calibre of some of King Content’s work were dismissed by Isentia chief executive John Croll who told Mumbrella the issue of quality, or lack of it, had not been raised by clients during dozens of conversations before and after the acquisition.

In-house editors and sub-editors pore over content to ensure it is up to scratch and nothing is ever published without sign-off by clients, he stressed.

Croll admitted he had been made aware of industry chatter that its contributors were paid below the market rate and said he subsequenty investigated the claims. But he insisted the reports proved unfounded.

“I had heard it [that King Content paid poorly] so we checked it out quite rigorously and did not find that to be true,” he said. “I am sure you can always find someone who has that view, but we had discussions with our freelancers and those who commissioned the work directly and they were positive about what we were paying. We have 1,500 contributors on Communique (King Content’s content marketing technology platform) and we have a strong return and retention rate of freelancers.”

Croll told Mumbrella the root cause of King Content’s woes lay not in quality or the delivery of service but in poorly-constructed contracts that did not lock in sustainable and on-going revenue. King Content was not alone in drawing up such contracts. The issue was industry-wide, he claimed.

While clients invested in King Content’s technology and strategy, those tended to be one-off payments at the start of contracts, Croll explained. It was the content delivery which generated on-going, repeatable revenue, but that was drying up as clients began taking content in-house.

He said content marketing was more concerned with strategy and if the client “moved away from an agency mindset, that is okay”.

“Because the market was growing so quickly, King Content felt ‘We’ll find more clients’, but they became dependent on a couple of very large clients,” Croll said. “There wasn’t a problem in how we served clients, but a number of them moved their content in-house.

Croll: Problems related to the structure of contracts rather than quality

“We had built a digital environment, a strategy and audiences. At that point they said, ‘You know what we can build content ourselves’.

“There were four key clients. Two in-sourced content creation or scaled back content and two got to the end of how they wanted to position their brand in Australia. So in the August we were running well, but by September and October those revenues had turned off quite rapidly and that is what put us in a very difficult position.”

With Stanton at the helm, King Content has restructured contracts so strategic work is an on-going revenue stream which is revisited every quarter or half as more data is collected for the client.

“We are not so focused on just having a large bubble of revenue at the start of the contract but spread over a longer period of time,” Croll said. “That will build longevity of revenue. Our focus is on the data and the strategy and Communique, then we can work with clients about how they want to build content. We can do some of the work for them, they can in-source or there can be a mix.”

Several industry experts have questioned the thoroughness of Isentia’s examination of King Content and the content marketing sector as Croll – and others who were courting King Content – pondered a bid for the agency. But Croll defended its due diligence, saying he was “satisfied” with the process.

Research had showed content marketing was a rapidly growing sector, he said, while King Content’s revenue had soared from $7m to more than $20m since 2015.

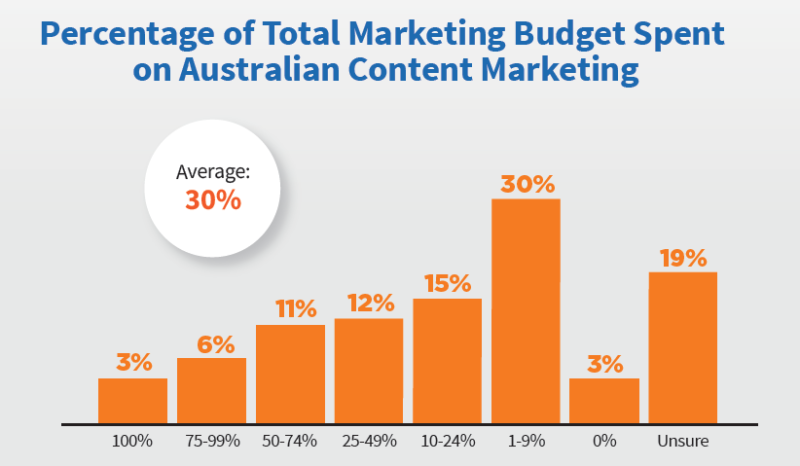

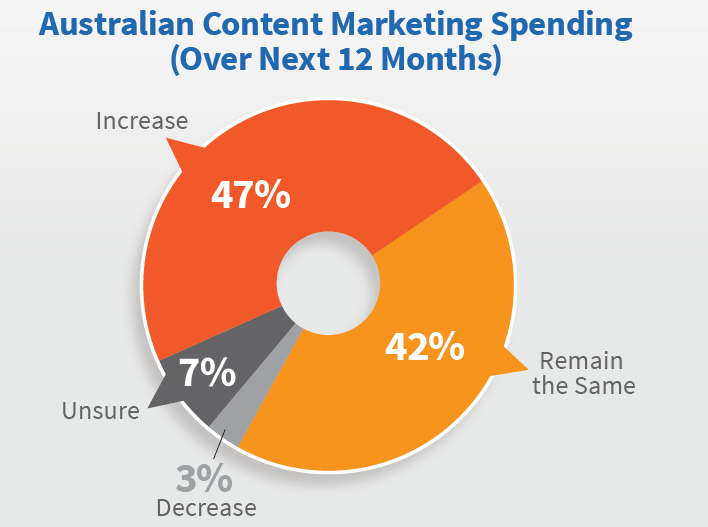

Figures from Content Marketing Institute’s 2017 Australian research report

“External and commercial due diligence showed the market growing strongly. There was a lot of transference of client investment from other parts of communication spend into the content marketing space, so we were happy with the industry sector and how it was going to fit with Isentia.

The CMI study found almost 50% of marketers were set to be handed additional funds for content marketing in 2017

“We also conducted about 45 interviews with clients of King Content and other providers and there seemed to be a consistency of spend. But could the due diligence have been better? In hindsight, I think there were some things in how those contracts were constructed that could have been better.

“The problem with due diligence is that you are always looking backwards, so it doesn’t interpret what a client’s decision is going to be in a years’ time. We are talking of a time that was 12 months after due diligence.”

In addition to the contract and revenue issues, integrating King Content and its entrepreneurial boss and culture into a corporate and listed company was always going to be something of a challenge.

Croll said he believed Hodges found moving into such an environment “a difficult transition” but insisted there was never any personal antagonism. He also rejected the view from observers that Hodges’ enthusiasm may have waned after completing the deal.

Rather than losing his drive after the sale – “Craig [Hodges] still had a lot of autonomy” – momentum was lost in the four to six months before and during the sales process, Croll said.

Positioning it for sale, drawing up an information memorandum, meeting prospective buyers – of which there were said to be a number – was a detailed and lengthy process, he said.

“It was competitive right down to the point where three people were bidding for King Content at the last stage. Craig is a fantastic sales guy and he knew the industry extremely well. But the sale was a big process and I saw momentum lost in that four to six-month period in terms of sales, pipeline and his contact with clients.

“I can see how people would interpret that he lost momentum but it was really the process that took a lot of time out of Craig’s relationship with the business.”

Croll admitted the framework of the deal also added complications as any structural changes at King Content, or the removal or addition of any costs could have materially impacted the earnout agreement.

“It made the integration harder but the positive thing is that we are happy with what Matt [Stanton] is doing with the business. It is now becoming highly integrated and we are seeing a good future of how it will run. We feel it is in much better shape than it was at the AGM.”

Stanton has set about forging closer collaboration between King Content and Isentia

New King Content chief executive Stanton insisted Isentia’s rationale for the acquisition remained sound despite the agencies’ struggles. Content marketing, he argued, was a perfect fit with Isentia’s media intelligence and insights division, both of which he described as strong.

Speaking to Mumbrella, Stanton, who launched a strategic review of King Content on his arrival, said it was clear the agency had over-stretched itself in its quest to expand internationally. He said the business has exited San Francisco and would focus its Asia operations out of Singapore.

In addition, Stanton admitted he was struck at the lack of collaboration between King Content and Isentia, while the “amazing” amount of data collected by Isentia was just not being exploited. Communique had also been “hidden away” and would be an area of focus, he said.

“Isentia has a great reputation and is a very trusted brand. It’s got a media intelligence business which is good and strong, an insights business which is growing and the third part which slots nicely together is content marketing,” he said. “For clients, the natural progression from intelligence and insights is what content and strategy should you be creating to change the narrative or amplify the message.”

Yet despite potential access to 3,500 Isentia clients, King Content – 18 months after the acquisition – “still felt like a completely separate business”, Stanton said. King Content did not initially move into Isentia’s Sydney offices.

“I turned up for work in Surry Hills where King Content was based and was walking up and down to the Isentia offices in Strawberry Hills, wasting all this time and thinking nobody is really talking to each other. There was a real lack of integration.”

Relocating King Content staff into Isentia’s offices in Sydney and Singapore was among the first tasks, while a sales structure has been created to exploit the in-house opportunities, he said.

“We have won more than $1m in revenue over the past two months because of Isentia clients, and that is without getting the process quite right at this point,” he said.

The former magazine publisher and Woolworths executive was reluctant to be drawn on events prior to his arrival, but he admitted the expansion strategy was “probably too scattergun”. For example, King Content was “trying to conquer Asia” rather than adopt a considered approach.

“I think there was a stretch in the organisation. The business is global but it’s a relatively small business to be a global business. It’s not a multi-national. You need a lot of resources to run a global business and to be fair to Craig and the guys they did a fantastic job, but when you do that you can spread yourselves a bit thin. They were trying to do too much everywhere so you start picking up jobs where you might not be as well-resourced or well-known for.

“King Content is a fantastic strategy, content ideation and creation business but you have to be careful you don’t go too far and do too much.”

Stanton stressed he was not planning a wholesale exit from overseas markets, but would return King Content to be run as a local business and make international general managers more accountable for results.

“Am I going to close any down? Never say never, but while they contribute to the business I’ll keep them open,” he said, adding that only a third of King Content’s business is generated out of Sydney. “There are huge opportunities in Asia out of Singapore, London has growth opportunity and New York has had an uptick in pitches. It also helps our overall business having a UK and US presence because there are a lot of leanings you can get from those markets.”

In addition to internal difficulties, increasing competition in the content marketing space is also likely to have contributed to the financial and operational pressures, Stanton said.

Isentia’s listed status prevented Croll or Stanton from commenting to Mumbrella on King Content’s performance over the past three months.

For the time being, however, any stemming of revenue declines and losses is likely to be welcome, and the market reacted favourably to Isentia’s presentation at last week’s Macquarie conference, in the main because it flagged no further deterioration.

The market, and content marketing industry as whole, will be watching closely come August and Isentia’s full-year results.

- Postcript: On August 1, 2017, Isentia announced that it was axing the King Content brand and bringing content marketing within its main operations. And on October 26, 2017, Isentia announced it was exiting the content marketing business altogether.

Fascinating article!

I think Croll’s comments about “strong return and retention rate of freelancers” leave a lot open to interpretation.

As a freelancer on their books, I was never consulted about rates of pay. I began declining more and more work with them, as the rates of pay continued to fall (and the stipulated deadlines became increasingly unrealistic). Today I don’t really do anything with them.

But I’ve never formally requested to be removed from their books, meaning I am one of King Content’s “retained” freelancers.

The pool of freelancers just keeps growing, but ultimately they will vote with their feet and go where their skills are valued, appreciated and appropriately paid for. Afterall, we all have to keep a roof over our heads!

A race to the bottom on freelance rates only serves to push talented writers to your competitors, or out of the content game altogether.

I concur with the claims mentioned here about poor word rates. I don’t know how they can possibly attract quality writers at what they’re paying – i walked away when i was told what they were offering. Agencies like this are doing the industry or the writers who built it no favours!!

This is really interesting. Why would you spend 48m on this business?

Looking at the content on the King Contents site the stories are disposable and super low cost to produce. You can’t blame the low quality freelancers. If your a true content provider you own and control ‘paddock to plate’ As we all know in the content industry clients want cheaper, stronger, faster so the amount of clients need to grow creating an even cheaper result with even less control over the quality from the content company.

Sorry ‘Just sayin’

seems to me like a textbook case of the Captain of a legacy, media-derivative publicly listed business in structural decline and facing a revenue hole in a forward reporting period using shareholder’s money to buy what looks like a lifeboat but is really a leaky dinghy

he can’t see that it’s a dinghy because he doesn’t understand boats i.e. he doesn’t understand the marketing services industry. Media monitoring is as much a related field as a finger is to a toe. i.e. sort of feels like it’s the same kind of thing but when you properly analyse it, it ain’t nothin’ of the sort

Mr Hodges, on the other hand, played them all like a fiddle. Recognising that most corporate marketers have limited independent and analytical ability, and simply adopt the next shiny thing that industry media and spivvy sales-folks tell them to, he rode the content marketing wave like Kelly Slater and bailed before it sucked up on Reality Reef

Call me cynical, but i bet my bottom dollar that when he gets tired of counting his money, Mr Hodges will go looking for the next big shiny thing in mar coms services and is gearing up to build and flip that too. Maybe VR?

i admire what the man has done – he’s proven beyond doubt that every now and then, a brilliant salesman really is The Smartest Guy in the Room.

Content marketing is still very much in its infancy.

Clients are beginning to seek information, reach out and explore the space… I hope this continues to be encouraged.

As an industry we should be educating the market on the benefits of content marketing. We are not doing as good a job as the northern hemisphere that’s for sure.

Media consumption has changed. Content marketing revolves around content, context, relevance & distribution.

The ability to keep a brand always on, beyond just campaign activity makes sense, especially when it resonates with the audience it was created for. Content challenges the mass reach model in favor of developing a relationship around relevance. That’s why we are seeing the rise of the Influencer, the importance of authenticity and savvy marketers out there scheduling more of their money into sharing their stories in order to connect.

King Content & i Sentia may have their fair share of challenges, so does every media business at the moment. Who isn’t trying to evolve, re structure, change their legacy model or desperately seek their next digital, integrated, programmatic, bespoke edge?

i Sentia has all the ingredients to make this successful as with any new partnership they may just need to adjust their model. Good Luck John & Matt. Keep at it!

I freelanced for them about 2 years ago and vowed never to again. It was a shambolic experience and I simply told the editor it was not worth my while for the pittance I was being paid. They were quite sneaky about the pay rate also – quoting X per word piece and then expecting you to also write a 100-word intro plus this, plus that, none of which was accounted for in the pay rate.

Good writing isn’t about stringing endless ‘keywords’ together. It’s high time agencies and clients understood that the value of this.

Another Steve Jones corker. Great read.

High staff turnover recently.

“the audience has moved on and wants brands to take more time, get to know them, and build engagement over time.”

This has to be one of the most delusional things I’ve read on here, it could be straight off an advertising satire blog.

In this day & age… people want brands to take more time & get to know them. Seriously… just think about that for a second

Shoddy, speculative journalism that really considers the gloss not the substance of the issue. Normally I love your stuff Mumbrella but this one does not hit the mark (both in understanding the numbers, the opportunity or the reasons for the deal).

Excellent article and insight to the workings of this tricky niche.My experience of Australian Content writing showed the inexperience of many brands’ Marketing teams. They so often compared it to SEO or ‘blogging’ writing. Or did not grasp the idea of long term strategy, and the power of well structured content. Brands whose team can’t communicate about a solid marketing product, are creating a wasteland of cheap words. And why Australian content companies are finding it difficult to maintain solid revenue. The quality writers are here but falling on deaf ears. Don’t shoot the messengers. Send your Marketing team back to media class.

As a former King Content employee, “It was sell, sell, sell without the rigour and structure and process to deliver against that” sums it up beautifully.

Having said that, in amongst the shambolic chaos, working there had its moments and Craig was neither the sole cause of the problems, nor its saviour in my opinion, especially if you were just one of the cogs in the machine churning out content the best you can.

“People want brands to get to know them”? Maybe not. But in the increasing deluge of crap out there online, people want to read, watch and listen to things that are relevant to them. Things that are good quality. A big part of the problem content marketing / brand publishing faces is a desire of (some) brands and (some) agencies to do things on the cheap, and if you pay peanuts, well…

Content marketing agencies should be the ones who’re fighting the corner for quality and showing how things *should* be done, rather than taking money anyone offers and churning out crap for a short term gain for the highest margin. Some are. Others aren’t.

So no mention of Paul Ford? – the other Founder. What role did he play in this whole mess for shareholders

@Simon Hopkins, no offense, but how can you say Content Marketing is in its infancy? Fundamentally, every media owner and direct marketer has been involved in Content Marketing since printing presses began, it was either disguised as editorial or called an advertorial.

I think King and Craig Hodges’ genius was in packaging up a low-margin, high-touch business and make it seem more than the sum of its parts.

Isentia have only themselves to blame, I think @goldfinger summed it up beautifully. Paying that much for a business with no tech at its heart is just stupid…

Buyer Beware…

Good point! Was wondering that myself

I have a friend who worked directly for King Content for a few years including during the transition. They had a revolving door of permanent staff (and freelancers), which meant management of new and existing staff suffered. They took on more work than they could handle and created bottlenecks by not hiring enough staff in key roles. Hearing the stories on a weekly basis from my friend about staff constantly leaving and poor inter-departmental comms, it amazed me that this didn’t come crashing down sooner.

A great example of scaling fast and loose, then selling … and somehow selling but not being at all shackled.

Perfect storm

– new buzzy marketing area with little rigour behind it

– desperate legacy company seeking new angle with access to cash

– no diligence applied to valuation

– opportunist founder there to take advantage of it all

– no earn out

Last time we saw it was Spreets and the scenario was almost the same – overpaid and by the time they realised they didn’t buy much it was all too late.

Think bananas in pyjamas . Paul was B2.

Both bananas are very accomplished at building, selling and flipping with special reference to selling. See gold finger. Paul built and flipped an SEO agency with someone else well before google closed that boom niche down. One suspects Paul knew the end was nigh for that niche well before that flip. Craig built stuff too but wasn’t as accomplished in flippingg . Even if you say they’ve not really built and flipped anything that lasted you can’t argue they’ve not been clever. Maybe they should be on a watch list for unsuspecting acquisition virgins for the foreseeable future.

This article unfortunately says more about the lack of understanding about content marketing in Australia than it does about King Content.

Like all bespoke content marketing agencies in the region, King Content’s business and thinking is ahead of the curve, and many of its challenges are unique because it is a different kind of agency that it’s competitors (and clients) don’t quite understand. It is digital first but does minimal media buying and programmatic meaning that it is not an advertising agency. But it is also a more strategic and data-centric agency than a PR or creative agency. Content Marketing agencies of King Content’s ilk are a new approach that the Australian marketing industry refuses to embrace, which is why ads and PR stunts continue to win ‘content marketing’ awards in this country.

As another media agency, we have been working in partnership with King Content for one of our clients. They were an absolute nightmare to work with on the last campaign. A revolving door of contractors, with a new account manager per week – for a 2 month campaign!

Spot on, @History repeating: all of these factors are apparent — some in retrospect, but some were bleedin’ obvious from the outset. It’s clear from this piece, and also from what has actually happened, that isentia were/are pretty clueless when it comes to content and content marketing and thus being able to properly evaluate King’s true value, it’s strengths and weaknesses, and even the sustainability of its business model (which appears to have been churn and burn both in terms of staff and customers). It certainly doesn’t help that, as this story clearly points out, marketers and brands also have completely unrealistic expectations about content — what it costs, the importance of having a content strategy, what it can do and how quickly….this is an issue that plagues everyone in the content agency space.

Sell sell sell, do it on the cheap, quantity over quality. No surprise isentia bought King. Their modus operandi was just so familiar. King has faltered and isentia has propped it up, selling like mad to try and hide it from shareholders. When staff stop caring about quality a business that says it deals in intelligence loses its credibility.

Excellent and interesting article. I would add that I think it’s challenging for content marketing agencies when so many organisations are investing in in-house content marketing teams.

As described in the article, I agree that content marketing is a long-term game, requiring strategy that is deeply integrated with the business, its value proposition and understanding of its customers to build an audience and rise in the ranks of organic search. For this reason I think companies who truly see the value of content marketing and want to do it properly prefer to invest in people on their teams who are more likely to stay for a couple of years and be intimately involved with the business.

The companies that outsource content marketing already tend to have the mindset of achieving ROI quickly and cheaply – unfortunately setting it up to fail for the agencies that take on the work.

Everyone who is trying to stand up for content marketing and this result are kidding themselves. It’s a methodology that works but it’s better done in house. Agencies just sell, sell, sell and rip off the client using the adage that it takes time.

@Matt B. I think that’s an old chestnut. Yes everyone can point to the Michelin Guide at the turn of the century etc and magazines have been creating “native” content for brands to sponsor forever (they just didn’t call it that). But the idea that brands can be publishers on their own platforms at this sort of scale is new and still very immature in Australia. Just take the fact that for many brands this is a junior position where as in the US the CCO (Chief Content Officer) with a seat at the decision making table is commonplace.

PS. Advertorial is writing directly about products – content marketing isn’t. A common misconception.

As an owner of a 4 year old content marketing agency in London, I’m surprised that the focus (or salvation) of a digital campaign is still seen to be ‘content’. What is content without understanding the strategic value or direction of a campaign… it’s meaningless. ‘Content’, be it written, a digital asset, a video, the foundation of a social campaign or whatever, is simply the vehicle used to execute the campaign. The real value or tangible means of justifying any content campaign lies in the strategic and insight stage. Evaluating the opportunity, channels and audience type is a fail-safe way when assessing what content needs to be used. As noted in the article, selling content on a promise without fully understanding how it generates its ROI is a short-lived game. You’ll lose clients quickly and burn cash even quicker.

It was a really bad business transaction with no accountability towards the Isentia shareholders. How come CEO and company directors can walk away from this debacle without any harm? They can not wash their hands and just say shit happens. Why they failed to pursue required due diligence beforehand.There are people who lost a large sum of money on ASX, they must be pissed off after reading this. If Craig was guilty so is CEO and rest of company directors.

*You’re

Amen.

A friend of mine worked in the creative / content production department of King Content and would tell me stories about crazy management that had little understanding of realistic timelines and were not actually creatively minded themselves. Another complaint was the top heavy structure with lofty job titles. Lots of “Global head of such and such” but no people at the bottom to do the work. Seems there was a lot of talkers and no actual doers.

Well played Hodges, well played

+1 on lousy pay. Difficult work with ultra short lead times, but pay rates of aprox 25-40c on average for the work I was pitched. Err, no, ta.

Kings of content???

They made nothing but crap, why is that never in the discussion. Kings of content made crap content that very rarely connected…just a load of hot air.