‘Landmark’ programmatic investigation finds almost 50% of ad spend disappears before reaching publishers

A 15-month investigation into the programmatic supply chain has shown 49% of an ad buy is taken up by agency and platform fees and 15% which goes to an ‘unknown delta’, meaning half the costs don’t reach publishers.

The ‘world-first’ study has taken ‘far longer than could have been reasonably anticipated’ to complete due to a lack of support from agencies, but will have ‘global impact’ according to Australian Association of National Advertisers (AANA) CEO John Broome.

“This is truly a landmark study that has major global implications. There are many differences from country to country in programmatic advertising practices, but the fundamentals are the same. The UK study shows that approximately 15% of advertisers spend on programmatic, representing a third of ad tech supply chain costs is unaccounted for and the lack of transparent standards in the supply chain is preventing advertisers, media owners and buyers from getting visibility over this missing delta,” Broome said.

The report, published by the Incorporated Society of British Advertisers (ISBA) – the trade body for UK advertisers – the Association of Online Publishers (AOP), and auditor PwC, spanned 15 advertisers, 12 agencies, five DSPs, six SSPs and 12 publishers, with data collection running from January 1, 2020 to March 20, 2020.

Of over 250m data impressions provided for the report only 12% could be successfully matched, which the report says is indicative of the ‘unaccountable’ conditions around programmatic advertising.

“In our sample of 31m matched impressions, the winning bid in the DSP often does not match the gross revenue recorded in the SSP. This ‘unknown delta’ averaged 15% of advertiser spend. Our study shows that even in a ‘disclosed’ programmatic model, around one-third of supply chain costs remain undisclosed,” according to the report.

IAB Australia CEO Gai Le Roy said the study supported many of the standards the IAB delivers in Australia.

“It is pleasing to see the ISBA Programmatic Supply Chain Transparency Study recognise the importance of industry standards. The IAB locally and globally has been championing transparency in digital advertising’s value chain to ensure we have an efficient, effective and sustainable industry. Recommendations within the report that IAB Tech Lab Standards such as sellers.json and OpenRTB SupplyChain object are adopted by the market to improve transparency are welcomed by IAB Australia,” said Le Roy.

“We will review the findings and recommendations in more detail and work with our local members as well as other industry bodies to assess ways that the local market can learn and improve from this report. The Australian market is by nature very collaborative and the IAB is confident that we can be world leaders in driving adoption of transparency standards.”

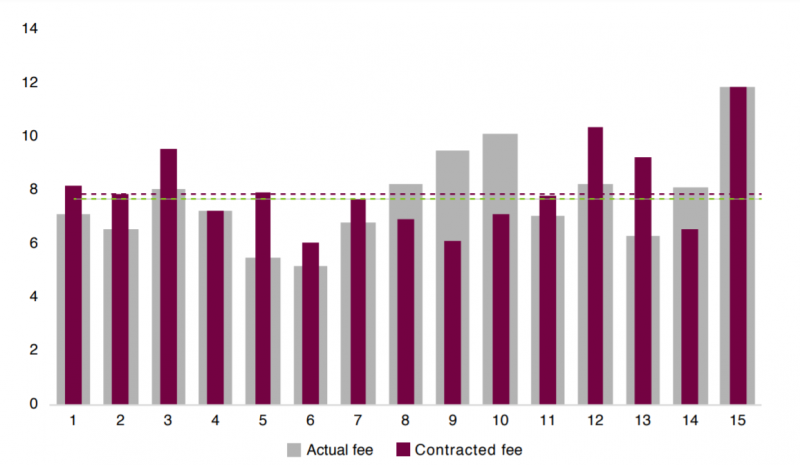

DSP actual fees and contracts both averaged ~8%, but with individual variations [click to enlarge]

Of the key findings in the report, a lack of clarity around how data is shared and which parties share data was highlighted, as well as overly complicated supply chains.

Sam Tomlinson, marketing assurance partner at PwC, said urgent change was clearly needed in the industry.

“Our two critical conclusions in response are: (i) standardisation is urgently required across a range of contractual and technology areas, to facilitate the data sharing that is a key step towards a more transparent supply chain; and (ii) all industry participants should collaborate to further investigate the unattributable costs and agree industry-wide actions to reduce them,” said Tomlinson.

Tomlinson said his team had significant difficulties accessing data due to non-disclosure agreements and when they did receive data it was in different formats, making it hard to trace.

The report recommends fixed fees across agencies to replace the varying fee model and make it easier to track programmatic spend and return. Verification tools are being used widely, found the report, but inconsistently and at different points in the process.

“The industry must make it simpler for participants to access and share their own data (or their client’s data), in a format that can be readily analysed,” read the report, arguing that “the industry needs to mature urgently to facilitate the data sharing that is a key step towards a more transparent supply chain.”

Media Federation of Australia CEO Sophie Madden said the study would help further the efforts to improve transparency in the industry.

“The MFA and our members, working closely with other industry bodies, have made significant gains in delivering greater transparency and will continue to play an important role in driving future industry-wide initiatives. We see this as critical to building trust in programmatic advertising and look forward to examining the ISBA learnings more closely and how they can be applied to our market. As highlighted in the ISBA’s report, we all need to work together in collaboration with Ad Tech vendors, to facilitate a shared understanding and application of transparency,” said Madden.

Some of the global agencies involved in the report include Dentsu Aegis Network, Group M, Omnicom Media Group, Carat, Mediacom, OMD, Mindshare, Essence, Wavemaker, PHD, Publicis Media and Zenith. Bauer Media Group, News Corp UK and Autotrader were some of the publishers involved in the research.

Noooo you can’t attack the tech stackerinos! Poor little ad bois!

You’re doing a heckin scare on the wittle bean DSPs uWu 🙁

Surely no one is surprised with this

Whoah, next they’re gonna tell us that video views are different on social.

Ha! Unknown Delta!

We all know what that is, and its the only thing keeping agencies in business.

Why don’t pubs in Australia band together to move up the chain incrementally, like Trust X in the UK

Tune in next week when AANA reveal 30% of ads aren’t viewable.

PLUS bumper addition – Does anyone actually check ad fraud reporting?

Followed by major expose – ‘30 day cookie windows are meaningless’ reveals client who bothered to compare against their own sales data

I would love to see TV buying looked at with so much scrutiny and rigor!

Surely if they talked to any trader, they will tell you this over the last 5 years. This clearly doesn’t state the cost of business…

And you are suprised? Smoke and Mirrors…….

When can we start referring to this as fraud?

This was not an investigation, it’s a bad example. So we should go back to rate cards and site serving to “trust us” publisher audiences? What a bunch of rubbish. Services cost money and technology improves outcomes. What world of business do you think we are in? Publishers had a good 10 years to properly share their customer base to advertisers and failed, so technology stepped in. Even at 50% spend reaching the publisher, the ads are 100’s of times more targeted (and valuable) than ever. Rubbish. Negotiate better media deals and pay good money for your tech. It’s what sells fucking products.

50% getting to the publisher? Seems like a pretty good deal!

Compare that to the $4 avocado you are buying at your local supermarket – The producer will be lucky to get 40c per avocado.

Distribution is expensive!

Perhaps the 2nd edition of this report will have a look at independent trading desks? I’m sure publishers would be much happier with that 51% from Tier 1s.