Woolworth’s results show Cartology revenue up 11% post Shopper acquisition

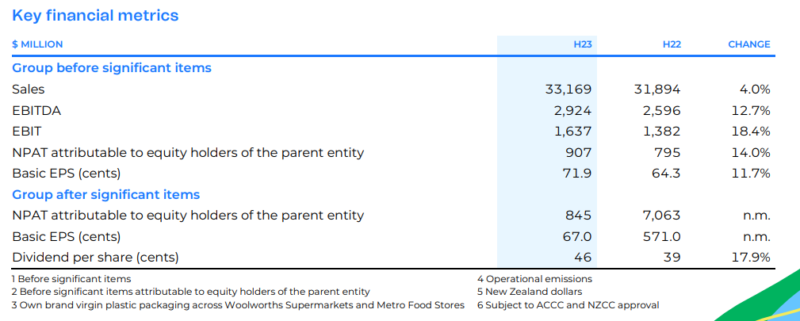

Woolworths Group has reported its latest earnings for the six months ending 31 December 2021. The group revenue from sales of goods and services has increased by 4% to $33.1 billion.

Its profit for the period was $849 million after-tax, and the earnings before interest and tax (EBIT) was $1.5 billion, without Endeavour Group’s gain post the demerger last year.