Netflix, Stan and Presto battle for consumer dollars, but what’s the difference?

The official arrival of Netflix in Australia today fires the starting gun on what could be one of the biggest marketing wars this year. Miranda Ward runs the ruler over the new local offering and how it measures up the its US counterpart, as well as local players Stan and Presto.

The official arrival of Netflix in Australia today fires the starting gun on what could be one of the biggest marketing wars this year. Miranda Ward runs the ruler over the new local offering and how it measures up the its US counterpart, as well as local players Stan and Presto.

Australians have never had so many options as to how they consume content – but for people looking to dip their toes in the video streaming waters the options are many and dazzling with many shows carried by more than one service, and all having different exclusive content.

I’ve been using the US version of Netflix for the last month, while I’ve also experimented with Stan and Presto. But which will consumers choose?

Pricing:

We’ll start by looking at the first thing to jump out at most consumers – how much they’re going to part with to get the services.

The Australian version of Netflix is cheaper than it’s US counterpart, with access to the Aussie platform beginning at $8 for a standard definition plan for one screen. Access to the US platform comes in at US$7.99 for the comparable service – about $10.16 in Aussie currency per month. And when you add to the cost of the US service the extra expense of the VPN needed to access it, around $40 per year, the savings start to add up.

The Australian version of Netflix is cheaper than it’s US counterpart, with access to the Aussie platform beginning at $8 for a standard definition plan for one screen. Access to the US platform comes in at US$7.99 for the comparable service – about $10.16 in Aussie currency per month. And when you add to the cost of the US service the extra expense of the VPN needed to access it, around $40 per year, the savings start to add up.

Stan, Fairfax and Nine Entertainment Co’s streaming service, is available at $10 a month for access to its movies and TV shows, but that makes it available across three screens and in high definition.

Stan, Fairfax and Nine Entertainment Co’s streaming service, is available at $10 a month for access to its movies and TV shows, but that makes it available across three screens and in high definition.

Netflix has two other tiers – two streams in high definition for $11.99 per month, and 4K ultra high definition family bundle across four screens for $14.99 – known as the ‘family bundle’.

Foxtel and Seven West Media’s venture Presto is more complicated with two tiers.

Foxtel and Seven West Media’s venture Presto is more complicated with two tiers.

It starts at $9.99 a month for access to either movies or TV but not both, for bundled access users will need to pay $14.99 a month. All subscription tiers are currently available across Windows PCs, Macs, iPads, select iPhones and Android devices and via Google Chromecast.

The real question is how many people will part with around $120 per year for more than one of these services?

Netflix has the advantage as any revenue here is new – it’s not cannibalizing its own services.

Stan and Presto will have to be slightly more circumspect in how they operate – careful not to move consumers away from their lucrative TV offerings – which generate vastly higher profit margins than these services can on subscription models.

Foxtel has been singled out as the business most threatened by these services – and it will need to hang onto those lucrative subscribers and somehow persuade them Presto is an ‘and also’ service they need – a tricky task.

It will also be interesting to see how the signups go with younger demographics – with many now used to accessing content on demand via free torrents and downloads – can they be persuaded to part with the price of a couple of coffees every month to give something back to content creators?

There could be some interesting marketing around behaviour change to be done here.

Content:

So with relatively little to choose between them in the way of price, it will come down to content.

There are thousands of titles from around the globe from different content owners signed up to these services. But it’s a complicated landscape – with different services holding different first run and second run rights with various distributors the waters are very far from crystal clear.

Sydney software developer Kenneth Tsang has made a spreadsheet comparing Netflix ANZ to its US counterpart. The US platform boasts a total of 8,499 pieces of content compared to 1,116 pieces of content currently on the local version according to Tsang’s analysis.

Sydney software developer Kenneth Tsang has made a spreadsheet comparing Netflix ANZ to its US counterpart. The US platform boasts a total of 8,499 pieces of content compared to 1,116 pieces of content currently on the local version according to Tsang’s analysis.

While there was speculation Netflix Original series, namely House of Cards and Orange is The New Black, wouldn’t be available on the local platform due to licensing agreements with local providers such as Foxtel both series are available in full and the third series of OITNB will be available when it premieres in June. I’m sure this will be a hit amongst Ruby Rose fans as she makes her debut on the show.

Stan launched with 750 titles – including exclusive content like Amazon shows Transparent and Mozart in the Jungle and its biggest drawcards Breaking Bad and Better Call Saul – but has been adding more to its library since coming to market in January.

Stan launched with 750 titles – including exclusive content like Amazon shows Transparent and Mozart in the Jungle and its biggest drawcards Breaking Bad and Better Call Saul – but has been adding more to its library since coming to market in January.

Presto TV launched with a collection of shows from HBO, Showtime, CBS Studios International, Viacom and Hasbro Studios as well as local content from Foxtel, Seven and ABC Commercial. Its movie offering boasted content from major studios including MGM, NBCUniversal, Paramount Pictures, Roadshow Films, Sony Pictures Entertainment, Twentieth Century Fox, Walt Disney, Warner Bros ICON and Studiocanal.

Presto offers a good variety of TV content, with local drama Wentworth a drawcard. The Sopranos, The Newsroom, The Wire, Big Love,Homeland and Entourage round out the content, with Glee, Modern Family and Veep offering more light-hearted alternatives here.

But it does seem to lack the big buzz-worthy new show such as Better Call Saul to get people truly excited about it – possibly as a result of not wanting to take away from the pull of Foxtel and Seven’s exclusive new titles.

Stan scores brownie points, and no doubt more viewers, for securing the prequel to Breaking Bad which is noticeably absent on Netflix both in Australia and the US. for me it scored extra points for offering US series Hannibal – which Netflix offers via its DVD service in the US.

In terms of the technical side of things, Stan and Presto in my experience are still ironing out the glitches, with problems with errors and longer buffering times when compared to the Netflix platform.

As a user who wants access content to be quick and easy this is a major problem which could well result in me finding the content elsewhere. Colleagues have also reported issues with streaming to Chromecast as well on Stan – another issue which will need to be sorted quickly.

Personalisation:

Content discovery is a big issue for these new platforms, with so many titles displayed together users can be bamboozled.

Netflix has led the way in Amazon-style recommendations – working out what people might want to watch based on their current show choices. By choosing a few shows you like when you sign up the algorithm is already getting up to speed on what else you should be checking out.

This is something that is noticeably absent from Stan and Presto.

When setting up my Netflix account I chose Orange is the New Black, Breaking Bad and 30 Rock and was recommended shows such as Bob’s Burgers, Spartacus, Futurama, How I Met Your Mother, That 70’s Show and Bates Motel: five out of these six shows I have watched all or part of and enjoyed.

(And yes, these were the shows I was recommended when I signed up for the US platform.)

Stan does offer some suggestions for what you might like – but in my experience these have thrown up some pretty random choices – like Irish comedy drama from the 90s Ballykissangel while I’m watching Better Call Saul.

Netflix offers a “kids section” and allows parents to set up profiles for their children which enable them to only access kid-friendly content. Stan also has a kids section and offers users the ability to have multiple platforms just as Netflix but with a pin-code needed to switch between profiles.

Netflix offers a “kids section” and allows parents to set up profiles for their children which enable them to only access kid-friendly content. Stan also has a kids section and offers users the ability to have multiple platforms just as Netflix but with a pin-code needed to switch between profiles.

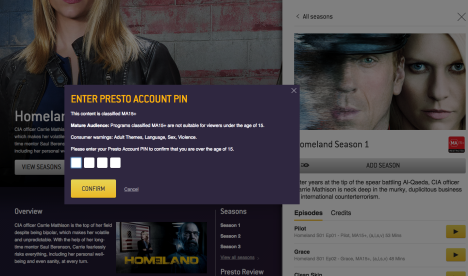

Presto has taken the digit pin code to the next level with it needed to be punched in when viewing non-PG content, a bit of a turn-off for childless types after using both Netflix and Stan.

Marketing:

All of these platforms are ad free – but that doesn’t mean there won’t be options for advertisers. Currently product placements in Netflix Original series is the only way advertisers can get their products in front of viewers. Locally this will rely on Netflix investing in local productions to ensure local clients can get their brand on screen.

The US behemoth also employs native advertising as part of its own promotional activity. Last year Netflix worked with the New York Times on a piece of branded content on women inmates tied to the hit series Orange is The New Black, a clever way of connecting the Netflix brand with issues and other brands in a way that doesn’t detract from the user experience.

Stan has already indicated interest in local productions, confirming a six-part series called Wolf Creek, there could be opportunities here for local advertisers to get their brands showcased via product placement.

While Presto is also ad free marketers might be able to leverage Foxtel and Seven for product placements around their own shows which will be exclusive to the platform.

It’s a case of two evolving platforms versus one well-established global player.

Having tried them all I’m sticking with my VPN and the US service – for the time being. I’ll keep my eye on Stan as it does have potential, but until some of those issues are resolved I’m team Netflix US through and through.

- Miranda Ward is a reporter at Mumbrella

Linkedin

Linkedin

Question: do any of the platforms do sports? All I am really looking for is sports and movies. Best option?

I am a current Foxtel customer, paying about $70 per month!

User ID not verified.

@ confused human — you’re not going to get sport at $10/month

User ID not verified.

You must watch waaaaaaaaay to much netflix to actually ‘stick’ with a service.

User ID not verified.

Well I’m sticking with Netflix and Stan + a dns proxy to swich netflix regions to get different content (theres a fair amount of stuff on local netflix -disney stuff mostly thats not on US netflix).

Presto is a non starter being back in the last centiry of SD only.

User ID not verified.

most of the US stuff is censored; if we get Netflix content will that also be censored?

User ID not verified.

I agree with Miranda. Good looking too.

User ID not verified.

People are going to disappointed when they find out what Netflix is.

It’s not a “vrtual video store”, its like a normal FTA channel only you pay not only for the channel but also the distribution costs. There are no recent release movies or sport ; just old stuff like Robocop and Miss Congeniality 2 and a few lame cable TV programs that the FTA channels couldn’t bother buying.

User ID not verified.

Yes John, lame shows like House of Cards and Orange is the New Black

User ID not verified.

@John – Its nice when your kids “make it” isnt it 😉

User ID not verified.

Miranda touches on an important point. The content algorithm. The content wars will only last so long and the marketing budgets will front-load at launch and struggle to maintain.

Netflix spends 150m a year on their recommendation engine, much more than the tens of millions in marketing quoted above and who knows how much more than presto, Stan etc spend on their algorithms.

This will come down to what users want to watch next, not necessarily now and Netflix will pluck something from their database of 80,000 genres that you never knew you might like. Maybe not immediately but in the long run it will be unbeatable.

Or not…just wanted to share a different perspective. All I’ve seen and heard so far is the content or pricing wars and very little on the experience and retention.

User ID not verified.

Let’s be honest, this article was long so I only skim read it. From what I saw, it’s a neat comparison.

However, I’d like to point out that House of Cards is also on Stan. In regards to pricing, Stan is also the cheaper option with 3 devices for $1ish more than Netflix. In my opinion, Stan comes out well on top in both content and pricing. I also haven’t experienced many app glitches – their app is great. Netflix is a huge disappointment

User ID not verified.

HOuse of Cards and OITNB are pretty good shows. Bloodlines and Marco Polo are awful. Let’s be honest Netflix Australia selection looks and feels like a $10 a month service. Foxtel looks and feels like a more expensive service. Nothing is free and you get what you pay for – as you should in a market economy.

User ID not verified.

Hi Too Long,

Thanks for the comment.

Stan has the original British version of House of Cards which was made in the early 90s, the Netflix series is a US remake.

Cheers,

Miranda – Mumbrella

Netflix will create huge problems for the local industry, it simply wont invest in local content and frankly why would they.

The Government needs to step up and either tax them then use the money to invest back into local content or set Oz quota requirements.

Kimmy Schmidt is a fun little show and House of Cards S1&2 were great, however Netflix isn’t quite there yet in terms of being a quality production house, having said that I’m sure they’ll get there in the coming years.

User ID not verified.

Which streaming service provides the most local content? Perhaps iview? But amongst Stan, Netflix and Presto?

User ID not verified.

@Liam the major sports, locally and globally, will do their own thing. Have a look on Apple TV, you’ve got MLB, NBA, NHL etc and now Cricket Australia too.

User ID not verified.

Just steal content for free @ The Pirate Bay, KickAss Torrents, etc!!!!!

User ID not verified.

Yes Ciaran, lame shows like House of Cards and Orange is the New Black.

Australians want recent release films and sport, not cr*ppy American TV series. We already get heaps of them free.

User ID not verified.

If you have Fetch TV you can get netflix through Fetch – might be worth trying first on a monthly basis.

Fetch/ Netflix and Fox sports for me, then wait and see how this all pans out over the next 12 months.

User ID not verified.

We have been using the US version of Netflix for about 18 months now, we are never going back. We also get Hulu, to say we are spoilt for choice is an understatement. Sometimes it takes us about 10 mins just to choose what we want to watch, the choice is overwhelming. Just wait till the HBO service starts & every show worth watching will be available. To those of you being negative, try the free 1 month trials and see just what you have been missing, then you can comment with some authority, otherwise you just sound like grumpy old men, afraid of change.

User ID not verified.

Surely one of the the BIGGEST issue for “commercial” television is the fact that people are increasingly zapping through ad breaks – or jumping onto social media during them – often encouraged to do so by shows like X Factor etc. Does ANYONE sit through ad breaks anymore? Just a matter of time before advertisers realise they are spending big bucks on a product no one is consuming. Let’s face it, as people become more accustomed to watching movies etc uninterrupted on platform like Netflix etc – I believe traditional ad breaks are on their last legs – just like the demise of the classifieds (rivers of gold) in newspapers.

User ID not verified.