REA Group increases marketing spend by 23% in wake of changing market conditions

REA Group, the parent company of realestate.com.au, has increased its marketing spend for the 2018 financial year, up 23% from $60.415m to $74.483m, the company’s financial results have revealed.

Chief financial officer Owen Wilson said most of that spend had been funnelled towards the group’s new financial services ventures, however CEO Tracey Fellows did note Fairfax’s Domain had become a more active competitor over the past three years.

REA Group’s main revenue generator is real estate listings and content portal, realestate.com.au, which is the market leader in terms of audience size and revenue in Australia. Domain is its primary competitor.

On a call with investors, Fellows said it was too early to speculate whether the planned merger between Nine and Fairfax – which controls 60% of Domain – would require REA Group to ramp up its marketing efforts even further.

“I think its probably too early to posture about some of the things that may happen as a result of the merger between Fairfax and Nine,” she said to investors this morning. “But I think you’d expect to see heavy marketing from them continuing on some of those platforms – albeit they use some of those platforms already.”

Wilson wouldn’t be drawn much further on whether marketing spend would have to increase further in the coming financial year, telling investors that the group’s marketing spend broadly increases in line with revenue.

“We’ve always said we’ll increase marketing spend broadly in line with revenue,” he said on the investor call. “This year we spent probably a large part of that increase in Australia on the financial services business. And so whenever we launch any sort of new offering or product, it does require marketing to get it going.”

The expansions were part of both companies’ attempts to become end-to-end solutions for consumers, who can now come to the platforms to consume real estate news, search for properties, connect with professionals and begin the home loan process.

REA Group’s realestate.com.au acquired a majority 80.3% stake in mortgage broking franchise Smartline, and also continued to build on its strategic partnership with NAB, which was announced in December 2016.

In calculating its FY18 financial results, however, REA Group did not include “significant non-recurring items” including transaction costs relating to acquisitions.

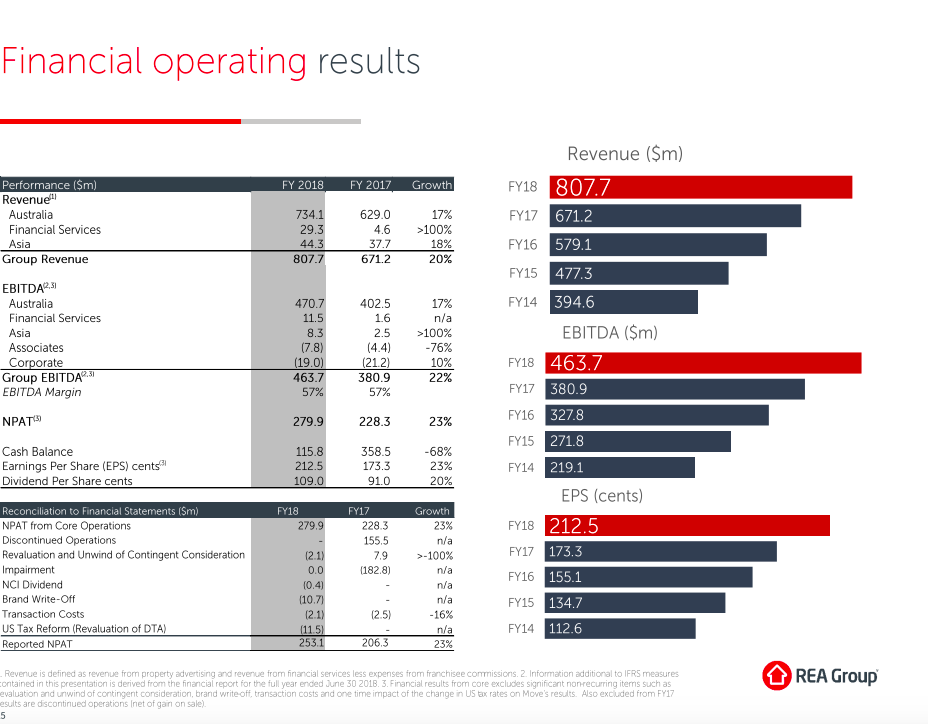

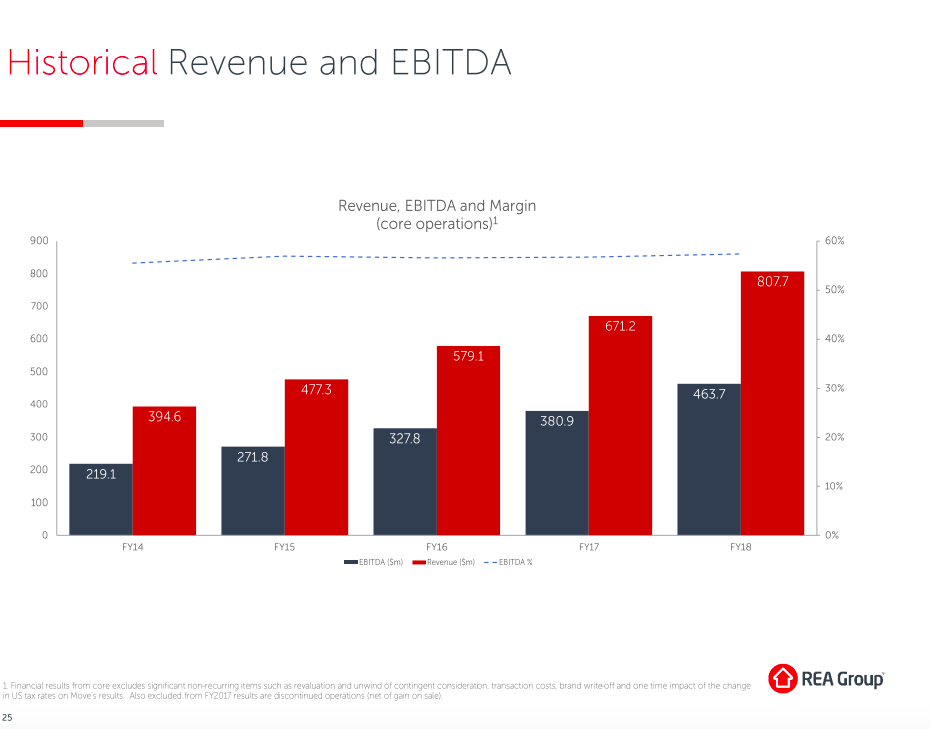

As such, REA Group was able to claim revenue was up 20% to $807.7m, EBITDA (earnings before interest, tax, depreciation and amortisation) was up 22% to $463.7m and a net profit of $279.9m – up 23%.

The revenue growth was driven by a 21% increase in the Australian market, despite changing market conditions.

The group noted the media side of its business had only experienced a marginal increase due to less new building activity, which directly impacts advertising on realestate.com.au.

“Against a backdrop of declining project commencements and display advertising on content sites, our media and other businesses were able to deliver a revenue increase of 4% to $94.7m,” a release to the ASX explained.

Owens added on the investor call: “REA Group as delivered an excellent result in 2018 given the mixed market conditions experienced through the year”, citing a downturn in residential listings.

REA Group also used the financial results release as an opportunity to spruik realestate.com.au’s market-leading position over Domain, claiming 2.6 times more monthly visits. REA Group also said consumers spend 3.8 times longer in the realestate.com.au app compared to its closest competitor.