‘Major digital investments are complete’: Profits plummet at SCA, but LiSTNR set to break even

The advertising markets “remain challenging” across the broader media industry, as SCA reported a 71% net profit dive, although there is light at the end of the tunnel, as LiSTNR is poised to become a big earner.

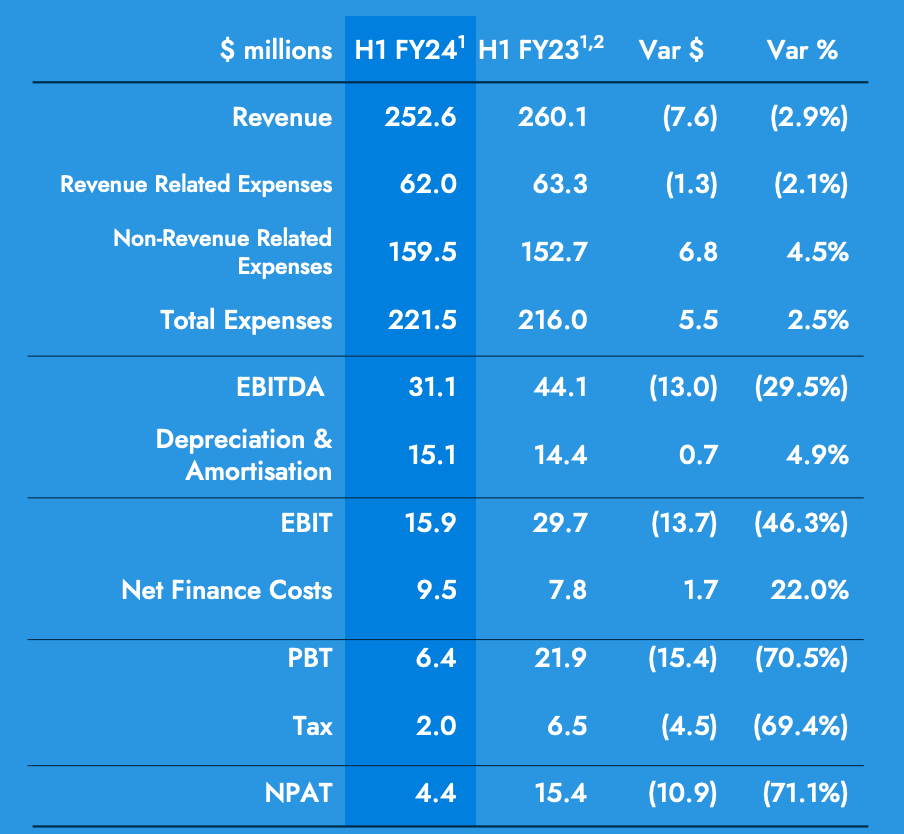

Southern Cross Austereo reported a modest revenue drop of 2.9% for the first half of FY24 , although EBITDA fell from $44.1 million to $31.1 million, a 29.5% dive.

Net profit after tax was just $4.4 million for the half, compared to $15.4 million for the same period the previous year – down 71.1%.

Broadcast radio revenue saw a decline of $4.1 million, a modest 2.2% drop, with Metro Radio down 6.4% ($6.2m).

Regional radio grew 2%, up $1.6 million, year on year, while EBITDA of $42.8 million is down 17.4% ($9m).

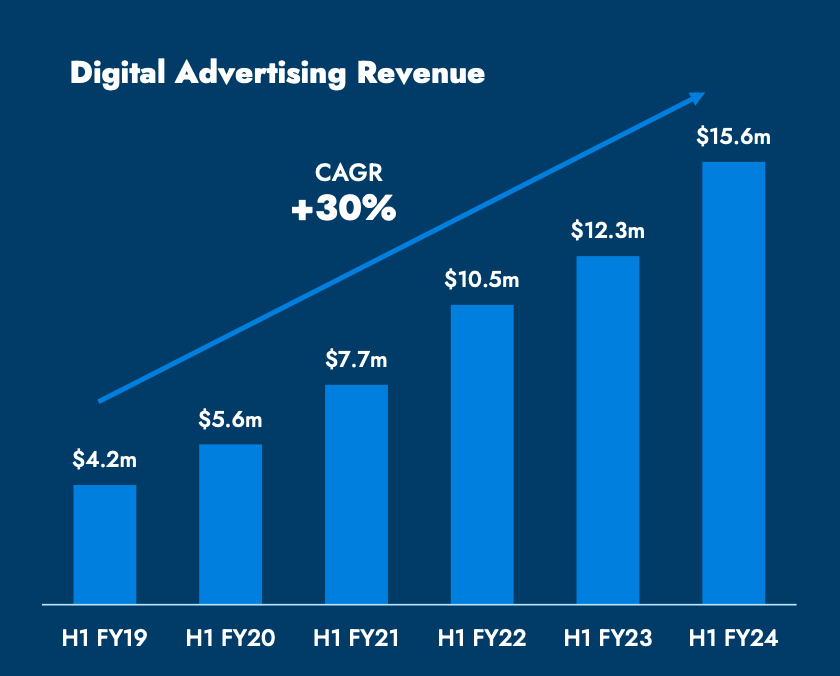

LiSTNR revenue has increased by 27%, to $15.6 million, with losses narrowing to $8.6 million, a 18.4% improvement on the first half of FY23. It remains on target to achieve ETIDBA break-even in the June quarter, and will progress to cash flow break-even in early 2025.

“Major digital investments are complete,” the group’s presentation declares, “improving both experience and commercial opportunity.”

The company’s strategic cost management review will deliver ~$20 million in savings in FY24, with these permanent savings increasing to ~$30 million annually in FY25.

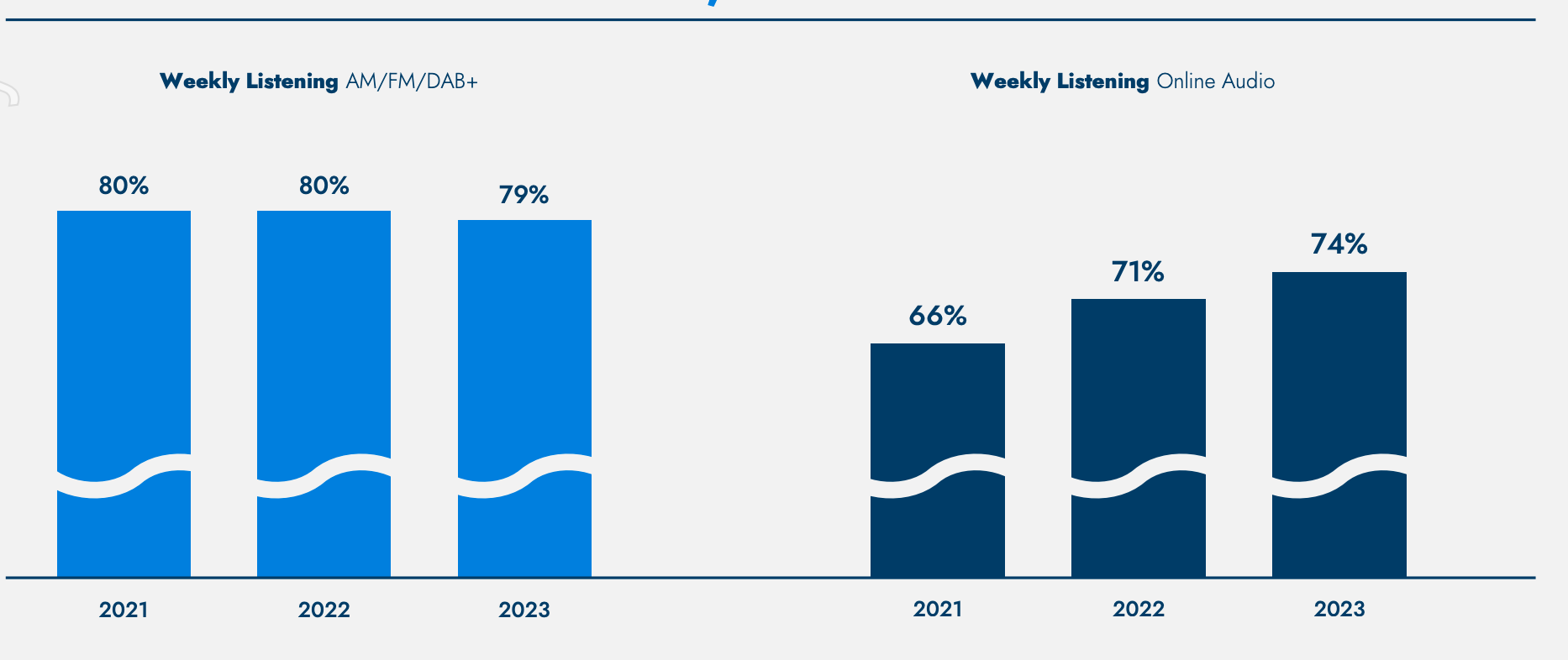

“SCA maintained and expanded monetisable audiences to record levels in our core radio and digital audio markets during the period. Importantly, our national leadership in the core buying demographics of men and women aged 25 to 54 provides our sales teams with a platform for growth in the second half and beyond,” said MD and CEO John Kelly.

“The impact of lower industry-wide national advertising expenditure was mitigated by the geographic diversity of SCA’s radio portfolio comprising 10 stations in Metro markets and 78 in Regional markets. Fuelled by robust performance from local advertisers, Regional Radio revenues grew by 2.0%.

“We were pleased that the number of users signed up to LiSTNR rose 60% year-on-year to 1.8 million. We have recently rolled out major enhancements to improve the user experience on LiSTNR and expect ongoing growth in the number of signed-up users and in the time they spend on LiSTNR.

“LiSTNR’s monetisable podcast audience network of around 7.4 million monthly listeners is the largest in the Australian Podcast Ranker. Together with strong growth in our streaming audiences, this continues to drive consideration by media buyers and programmatic advertisers. Digital audio revenue of $15.6 million was an impressive 27% higher than in the prior corresponding period.

Coupled with active cost reduction and increased listening hours, this positive revenue momentum means LiSTNR is on target to reach a breakeven EBITDA run rate during the fourth quarter of FY24 and to contribute positively to EBITDA from FY25.

“Our strategic cost management review has delivered significant cash savings, setting us up for improved results in the second half of this year and future years. And completion of our major digitisation investment cycle is enabling teams across all parts of our network to generate further savings and open revenue opportunities by optimising business operations and workflows.

“Regional television revenues continued to contract. We were pleased, however, to extend our affiliation with our principal programming partner, Network 10. The growing collaboration between our national sales teams in recent months has seen our power ratio – measuring conversion of ratings to revenue – return to above 100% in the four east coast aggregated markets.

“SCA teams around the country remain focused, committed, and passionate about our strategy, operating momentum, and outlook.”

As for the looming ARN takeover of SCA? The company offered the following update:

“Mutual due diligence and active discussions continue with ARN Media and Anchorage Capital Partners (Consortium) to determine whether the Consortium’s non-binding indicative proposal is in the interests of shareholders. SCA and the Consortium have not reached any binding agreement and there is no certainty these discussions will result in a transaction. In conjunction with its advisers, SCA’s Board has requested sufficient information to accurately form a view on the value and executability of the proposal.”

Last week, ARN chief Ciaran Davis told Mumbrella that “certainly we feel that that we’re in a position to to provide material value creation opportunity for both SCA and current [ARN] shareholders.

“In terms of an update, there’s a lot of diligence work has gone on on both sides, which is pleasing to see. And, as I say, you know, we remain committed to delivering the transaction for SCA shareholders.

“We believe it’s eminently executable. And we’d like to move towards that timeline of completion by the end of March.”

Linkedin

Linkedin

Have your say