Net profit falls 13% at REA Group as property listings continue to drop

The tough conditions facing the Australian property market have continued to affect the property portals, with realestate.com.au owner REA Group reporting a 13% drop in net profit for the first half of the 2020 financial year.

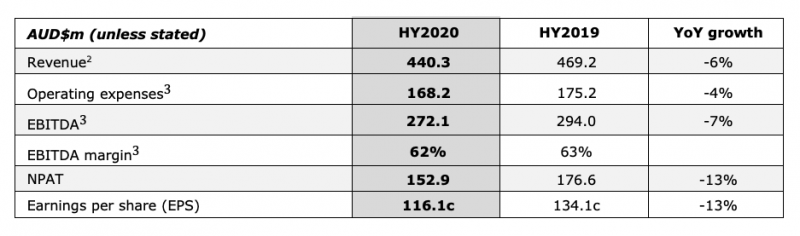

Revenue was down 6% and earnings before interest, tax, depreciation, and amortisation (EBITDA) dropped 7% to $272.1m.

Tough market conditions are continuing to affect the property portals with REA Group feeling the pinch

Revenue overall hit $440.3m and net profit $152.9m. REA reported national residential listings dropped 14%, including 17% in Sydney and 16% in Melbourne, the markets which have impacted the portals the most.

New project commencements declined 30% over the period.

In preparation, News Corp-owned REA embarked on cost management and efficiencies which resulted in a 4% reduction to $168.2m and boosted the speed of product delivery across the business, it said.

“Our results demonstrate the underlying strength of our business given the unprecedented market conditions. We now have a record number of customers committed to our premium listing products across both buy and rent. Customers see clear value in our product offerings, designed to deliver the highest quality leads to help their businesses grow.”

Wilson said the business had “consolidated its leadership position” with realestate.com.au, and saw a 30% increase in buyer activity across the site over the six-month period. In just the Australian business, which includes realestate.com.au, realcommercial.com.au and flatmates.com.au, revenue dropped 7% to $413.1m, with the residential and developer businesses taking the biggest hits. Residential revenue alone fell 6% to $283.2m, partially offset by a price change which came in from July 1, 2019.

Media, data and other revenue fell by 12%, with developer display advertising dropping significantly due to the fall in new project commencements. Financial services was also hit hard with revenue falling 14%.

8.8m people visit realestate.com.au on all platforms per month, according to Nielsen data. The business is focusing on increasing its REA members, which grew 16% year-on-year (YOY).

REA Group’s business in Asia saw growth in Malaysia, Hong Kong and Indonesia, the results of which buoyed the Australian arm of the business. The board declared an interim dividend of 55.0 cents per share fully franked for shareholders, consistent with the year prior.

Looking ahead, REA is cautious, warning that the signs of recovery in Sydney and Melbourne are still in early days, and that an increase of revenue in the latter half of the financial year would rely on increased listings. Residential volumes dropped 13% in January 2020 compared to the same period the year prior, with 7% in Sydney and 5% in Melbourne.

“Key indicators show that the Australian property market is recovering. REA Group is well placed to benefit from this momentum. We anticipate that more favourable listings conditions in the second half of FY20 will deliver a strong revenue outcome,” said Wilson.

In its bid to continue to expand its services and better prepare itself for soft market conditions, REA Group also announced the launch of the new Smartline brand, which will hero its broker offering. The rebranding for the mortgage arm of the business will be the primary brand in the Australia markets, folding the realestate.com.au Home Loans broker in under it.

The new brand will go live on Monday 10 February. REA Group chief financial officer Janelle Hopkins said: “REA Group took 100% ownership of Smartline in July last year. It was always our long-term plan to bring the Smartline and realestate.com.au Home Loans brokers together to create one strong business leveraging our combined systems, data and talent.

“While Smartline will lead the mortgage broker offering, realestate.com.au Home Loans will remain a gateway in digitally connecting realestate.com.au consumers to bank or broker options,” said Hopkins.

Sam Boer, CEO Smartline said: “We are proud of our well established 20-year market leadership position and the culture that we have created over this time. The Smartline rebrand and integration with realestate.com.au Home Loans broking business is another exciting step forward in the evolution of the organisation’s rich history.”