Publicis Groupe hit by economic consequences of COVID-19, but CEO says it can weather the storm

Publicis Groupe is one of the first holding groups to reveal its full financial performance throughout the COVID-19 pandemic, releasing its results for the first half of the calendar year this evening.

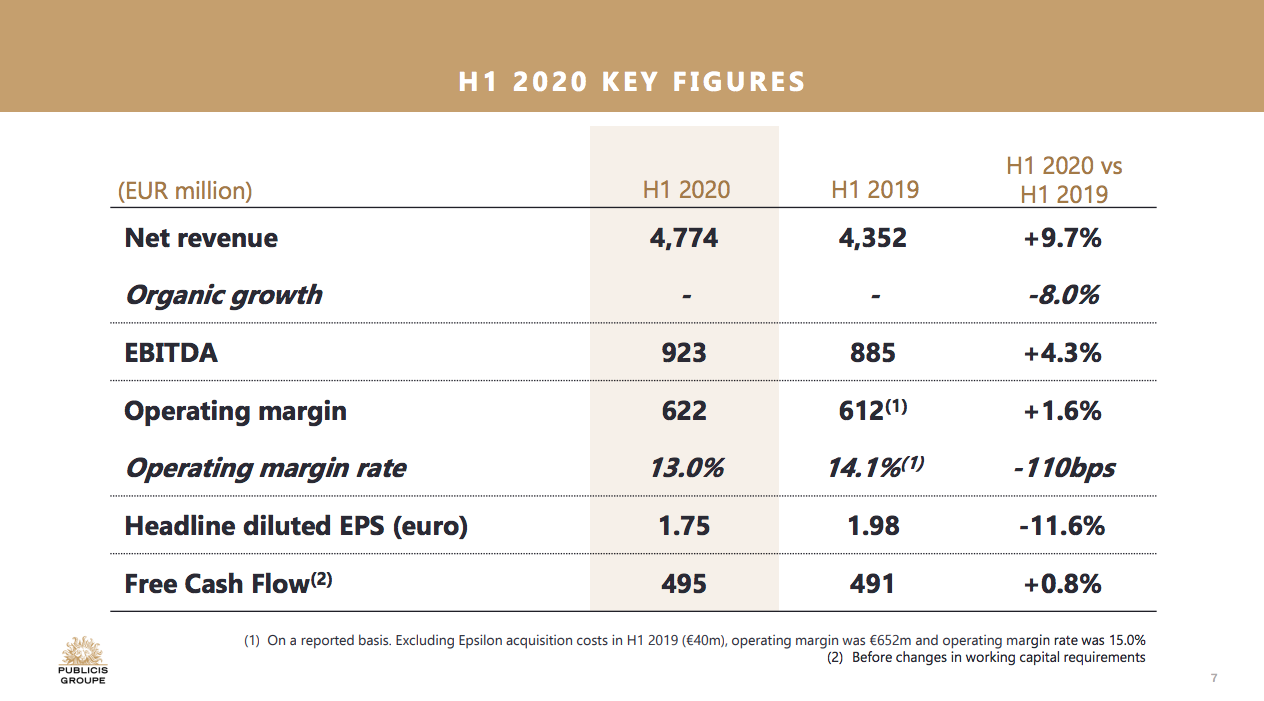

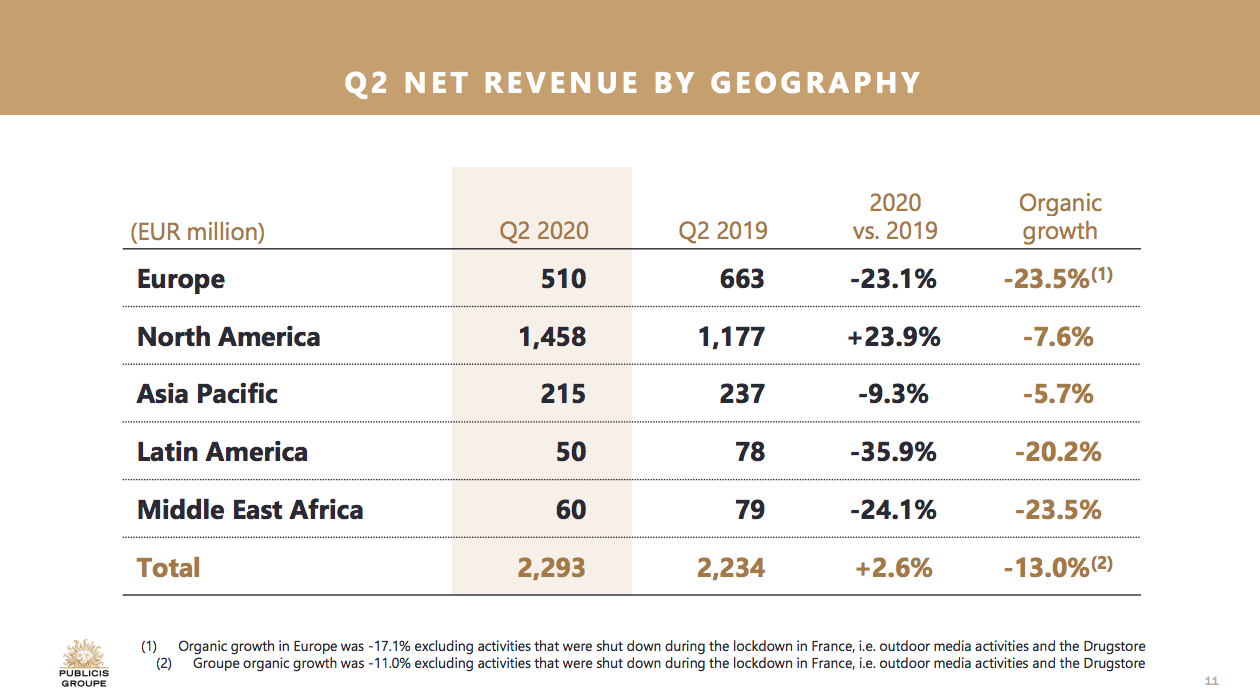

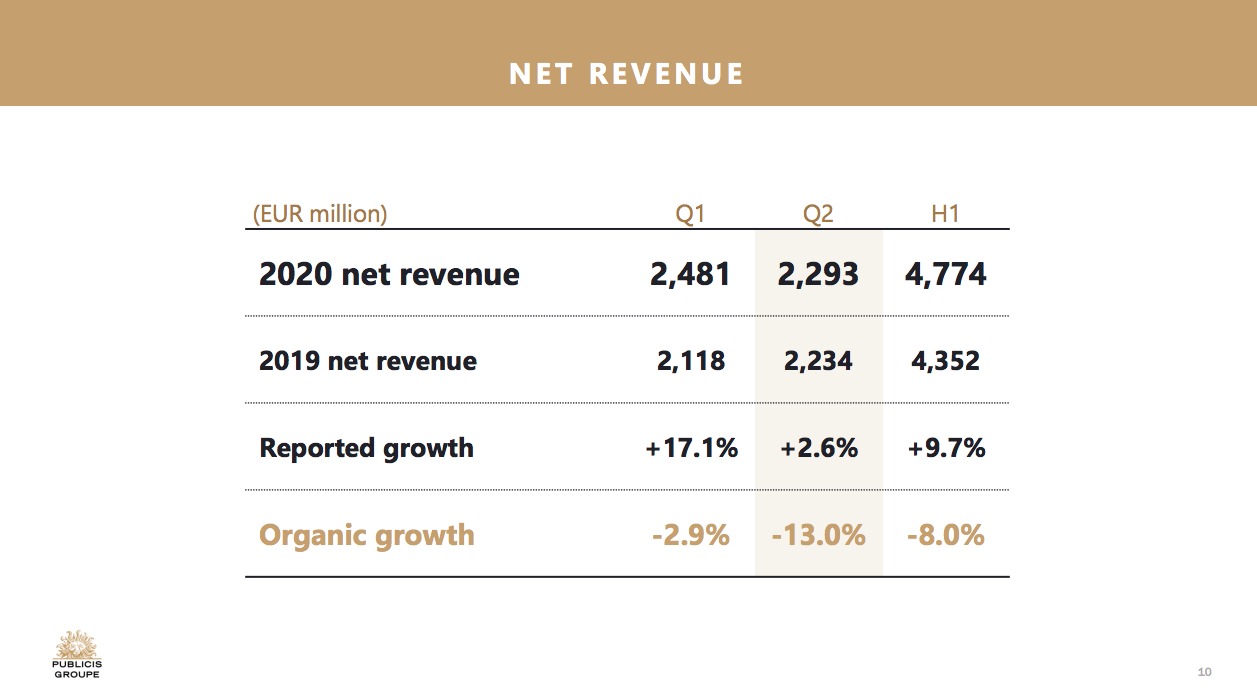

It noted organic growth was down 8% for the first six months of 2020, with the second quarter (April to June) hard hit, down 13%. Q2 was particularly difficult for its Europe operations, down 23.5%.

The group said it had entered the COVID-19 crisis with strong fundamentals, and pointed to strong tailwinds in the US and continued new business momentum as positive signs.

“Our revenue pipeline, supported by our resilient financials, helped us mitigate the effects of the COVID-19 crisis in the first half,” the group said in its presentation to investors.

Asia Pacific revenue was down 5.7% across the second quarter, from €237m (AU$384.85m) to €215m (AU$349,13). Australia was on Publicis’ second rung in terms of organic net revenue growth by country. Those who were better than 0% included Indonesia, India, Saudi Arabia, Singapore and Sweden, while Australia existed in the 0% to -10% category alongside Germany, Italy, Japan, South Africa and the United States. It remained ahead of China, Canada, France, Mexico, UAE and the UK (which declined between 10% and 20%), and Brazil, Netherlands, Russia and Span, which exceeded 20% in their decline.

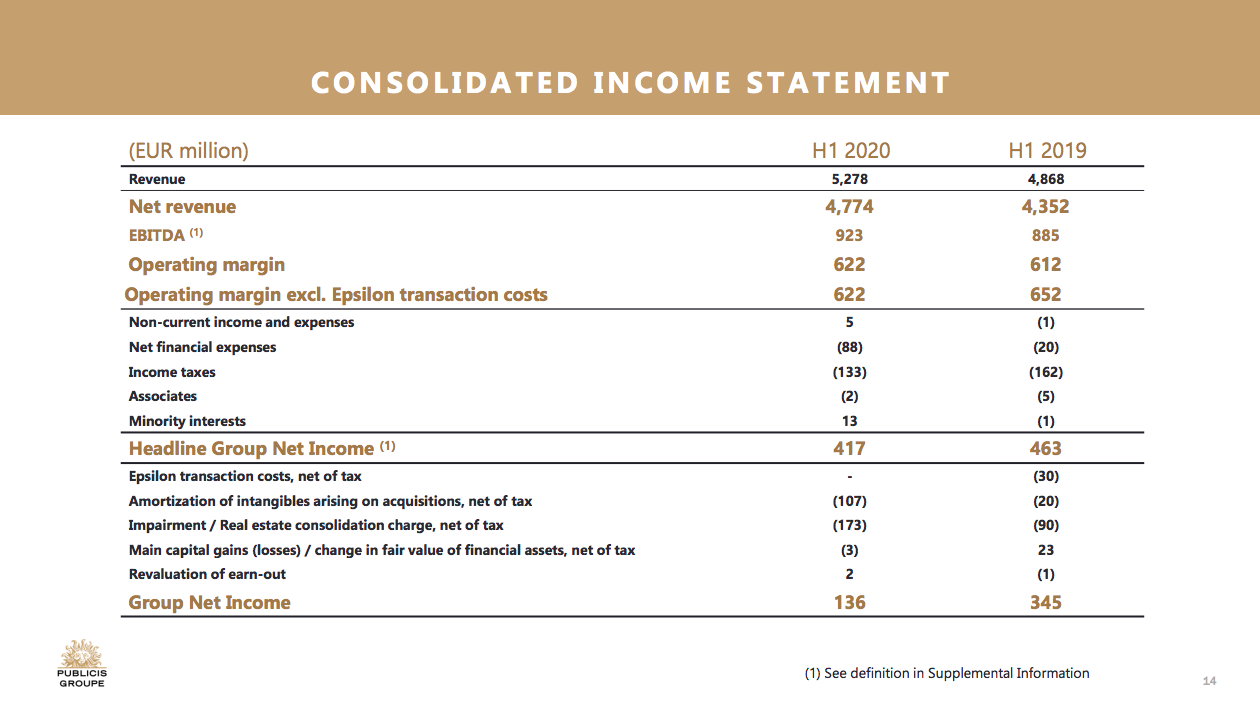

Net revenue across the board was up 9.7% to €4.774bn (AU$7.75bn), while earnings before interest, taxes, depreciation and amortisation (EBITDA) was up 4.3% to €923m (AU$1.499bn).

The group has also reduced its cost base by €286m, or 6.4%, which it said was implemented fast and early-on.

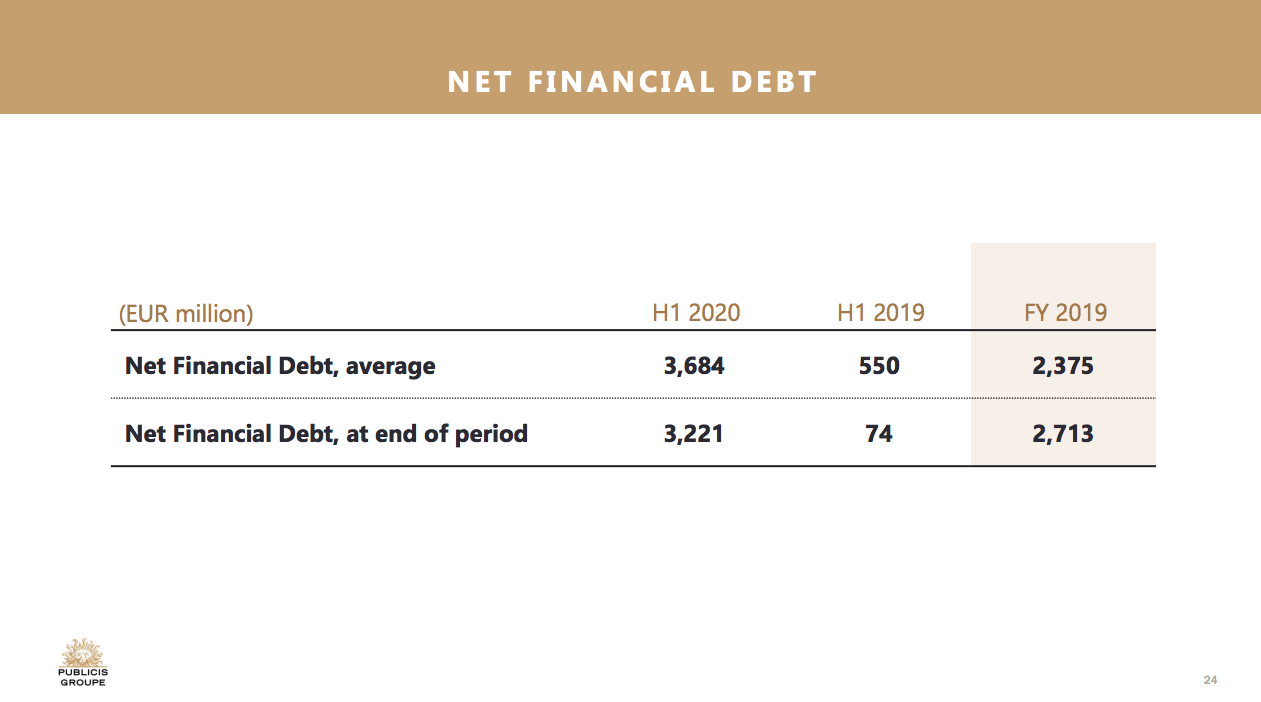

The group’s net financial debt at the end of the half climbed from €74m (AU$120.16m) to €3.221bn (AU$5.23bn). It said it hadn’t borrowed from any Government-supported fund, and had a healthy debt maturity profile with no covenant.

The company couldn’t offer a guidance for the 2020 calendar year as the full impact of the crisis remains largely unknown, it said.

“Q2 could be the low point, but it is premature to say whether H2 will be better or worse than H1 when it comes to revenue,” the presentation said.

It noted as business opens back up, expenses will increase again, but said it will aggressively pursue growth, accelerate new offerings for clients, and adapt costs to revenue and monitor financial resources.

CEO and chairman Arthur Sadoun said there is no doubt the industry has to live with the virus and its social and economic consequences for a while, but Publicis is well armed to weather the crisis.

“First, we have the products and services that our clients need. Over the last few weeks, we have seen an increased demand for all the capabilities that drove our strategy in the last few years: first-party data, breakthrough creativity, digital-first media and technology. The crisis has clearly accelerated the relevance of our go-to-market. We are uniquely positioned to help our clients take back control over their customer relationship, deliver personalised experiences at scale and reduce their cost while increasing their sales,” he said in a statement overnight.

“Second, in a world where our structure needs to be flatter, agile and remote, we are now truly operating as a platform. Our shared service organisation has proven its efficiency and we have finalised the implementation of our country model. This enabled us to react faster and immediately answer all our client needs in a seamless way. With the global roll-out of Marcel, 60,000 of our talents around the world now have a unique way to share their expertise, learn, collaborate, and contribute to client assignments.

“Last but not least, we have a very solid financial backbone and a strong liquidity position that will get us through these uncertain times.”

Globally, the holding group pointed to new clients including Volvo’s media account in China and ING’s creative in France, as well as an expanded scope with Reckitt Benckiser and GSK, and McDonald’s in China and Heikkinen in Canada.

Sadoun thanked all clients and global teams.

“They are our most precious asset and the ones who will drive our clients’ and our own future success. They have demonstrated outstanding commitment, solidarity, dedication and resilience despite the challenges they have endured, professionally and personally, during the lockdown,” he said.

During its Q1 results, Publicis said it would be implementing exceptional measures to face the coming recession including a a €500m (then AU$854.85m) cost reduction plan and compensation reductions.

Locally, Publicis has done what it can to protect jobs throughout COVID-19, however it recently conceded a number of roles were at risk as it exhausted other cost-cutting options.

It has also recently appointed Justin Billingsley, previously the CEO across Germany, Austria and Switzerland, as its first global chief marketing officer.

Publicis houses agencies in Australia including Starcom, Zenith, Spark Foundry and Saatchi & Saatchi .

How can the DEBT of Publicis go from 73M Euro to 3.2 BILLION EUROS in a single half-year? The debt increased 5,000% in 6 months? What the hell is going on? How did this happen? It’s a disaster yet the report barely mentions it… How can they report anything positive in light of this?

User ID not verified.

Hi Ron,

I’m trying to get more information on this, as I also found the number startling.

I will let you know if I get any more information.

Thanks,

Vivienne – Mumbrella

I could be wrong, but wouldn’t this just be Publicis Groupe’s acquisition of Epsilon for $3.95bn?

User ID not verified.

I thought the same thing and went in search of a transcript from the investor briefing –

https://finance.yahoo.com/news/edited-transcript-pubp-pa-earnings-162826337.html

Predominately it’s related to acquisitions (Epsilon) and earnout commitments.

User ID not verified.