SMI highlights continued COVID recovery in Aussie ad spend for August

The Australian ad market is showing significant signs of improvement, with Standard Media Index (SMI) data revealing the month of August was the strongest period recovery since the pandemic hit.

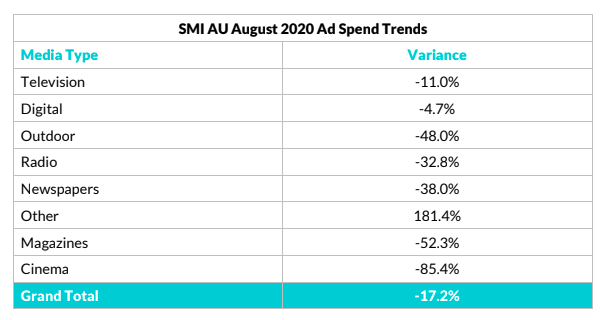

Ad spend fell just 17.2% over August, but that level of decline improved by 13 percentage points. It follows a 35% drop in June and a 28.4% decline in July.

In unveiling the latest data set, SMI pointed to areas including digital media as an area with the most promising ongoing results. It fell year-on-year by just 4.7% thanks to growth in social media and video-based websites (including streaming sites).

SMI AU/NZ managing director Jane Ractliffe said there are signs that the Australian market will continue to recover substantially in the coming months, looking to cues from the US market, which returned to growth in August.

Areas like TV, which reported just an 11% decline, are already showing signs of mirroring America, while the overall improvement in Aussie ad spend was reflected in other global markets including NZ (-18.1%), the UK (-18.7%), and Canada (-10.6%).

“The great news is that in all sophisticated media markets the level of decline in ad spend has now fallen well below 20%, while in the US advertisers have quickly returned to TV with most of the extra advertising spend flowing to news and the revived sports programs,’’ Ractliffe said.

“We’re also seeing strong improvements in TV advertising in Australia with the level of decline significantly reducing from 27% in July to 11% in August.”

August also saw a second consecutive period of growth in retail category ad spend, with supermarkets, chemists and online retailers helping to generate a 20% increase in spend for that area.

That was one of 10 SMI Product Categories which reported growth in that month, and Ractliffe pointed out the marked change compared to two months ago when all 40 categories were in decline.

Some categories, however, remain in significant decline, including cinema (-80.4%), magazines (-52.3%) and outdoor (-48%).

“Demand is clearly picking up quickly as this month we’ve also seen strong double digit growth in ad spend for household cleaning products, technology businesses (both for hardware and software products and services) and smaller categories such as oral and haircare,’’ Ractliffe added.

“Of course the COVID-affected categories such as Travel, Live Entertainment and Movies/Cinema/Theme Parks are still reporting devastating declines in ad spend but outside of those areas the higher demand from other categories is beginning to move the market to a far more stable position.”

The overall market trend for the year-to-date showed signs of improvement too, and thanks to a lower decline in August, is down 24% over the previous eight months.

Linkedin

Linkedin